Finance Automation

Under pressure to reduce costs, increase efficiency, and ensure accuracy in your financing firm? We get it. Traditional manual processes can't keep pace. That’s why finance automation software (and Wrk) is no longer a luxury but a necessity.

Wrk’s platforms also SOC 2 Type 2 compliant, ensuring your data is secure and meets rigorous industry standards.

Why Choose Wrk For Finance Automation?

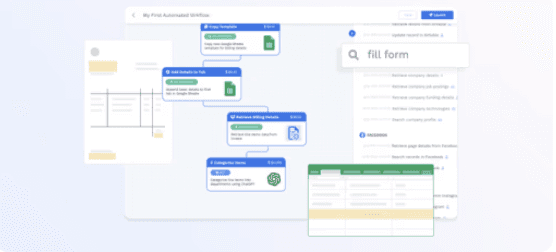

Wrk's hybrid finance automation platform offers a solution designed to meet the unique challenges of the financial sector. By combining APIs, web and desktop automation, human-in-the-loop (HITL) processes, AI, and OCR technology within one system, Wrk simplifies financial operations and delivers measurable outcomes.

Here are some of the top problems Wrk solves:

Yes, We Can Connect It All

Whether you’re working in modern platforms or older systems, Wrk makes automation accessible — without disrupting your current tech stack.

Companies Trust Wrk to Deliver Automation at Scale

The Wrk Advantage in Finance Automation

Secure by Design

Wrk’s platform is SOC 2 Type 2 compliant, ensuring that sensitive financial data is safeguarded against breaches and unauthorized access. Automated financial processes reduce the risks associated with manual data handling, while compliance with the highest security standards provides peace of mind for clients and stakeholders. This means organizations can confidently automate finance processes while maintaining rigorous privacy and data security protocols.

Scalable Finance, Seamless Growth

Wrk's platform is designed to scale effortlessly, accommodating increased data volumes, transaction complexities, and operational demands without additional manual intervention. This means businesses can expand their operations, onboard new clients, or process larger volumes of transactions without needing to overhaul existing systems. Our automation ensures that growth doesn’t compromise efficiency or accuracy, providing a strong foundation for sustainable expansion.

Built-In Accuracy & Compliance

Wrk’s automation solutions leverage real-time data integration and automated financial reporting to ensure accuracy at every stage. This minimizes human errors, ensures data consistency, and simplifies compliance with evolving regulations. Automated financial systems also keep track of regulatory updates, ensuring that reporting remains accurate and up-to-date, thus helping organizations avoid penalties and maintain strong relationships with compliance bodies.

Faster Financial Operations

Wrk’s finance automation software doesn't just eliminate bottlenecks—it transforms how financial operations are managed. By automating repetitive and time-consuming financial tasks like data entry, invoice processing, and reconciliation, Wrk helps businesses accelerate their workflows. Financial data can be processed and shared in real-time, enabling faster decision-making, reducing operational delays, and ensuring clients receive responses quicker than ever before.

Scales Effortlessly

Auto-scaling is second nature with Wrk. Our finance automation software automatically adjusts to increased volumes without compromising performance. As machine processes ramp up, we adapt licensing on the fly to get you the fastest and most cost-effective results. As your business grows, we’ll be there every step of the way.

Launches in a Flash

See ROI within hours and days rather than weeks and months. With your team as our guide, we integrate all essential applications into our Wrkflows while setting employee-in-the-loop measures for what matters most. The result? A bull market for your firm.

Outcome-Based Pricing

You only pay for the finance automation you use. Wrk offers an outcome-based pricing model, meaning you pay just cents for every successful Wrkflow. We’re committed to delivering value from the get-go.

Web and Desktop Finance Automation

Automation can’t do everything. Our employee-in-the-loop hybrid approach lets your people focus on tasks that need human interaction. Leverage the power of technology with human oversight to ensure key decisions, whether they’re verification, approvals, or reporting, are accurate.

Resources

Learn how automation brings financial efficiency

Explore our Other Solutions

Back to top