Publish Date

2022-09-15

Departments that cover financials, revenue reports, budgets, and accounting have a lot of responsibilities on their shoulders. Revenue can dictate many of the biggest business decisions since most are centered around finances and projections. Automating report revenue can save you hours or even days. It will help to increase report accuracy, cost savings, and even provide more transparency across the entire organization.

The biggest pain points that revenue operators face when using only manual reporting processes are focussed on time spent, higher possibilities of human error, and it keeps members of the reporting teams from more important matters, like procuring more sales opportunities. Read on to learn how automation solutions can help your team!

Automated reporting leads to competitive advantage and growth

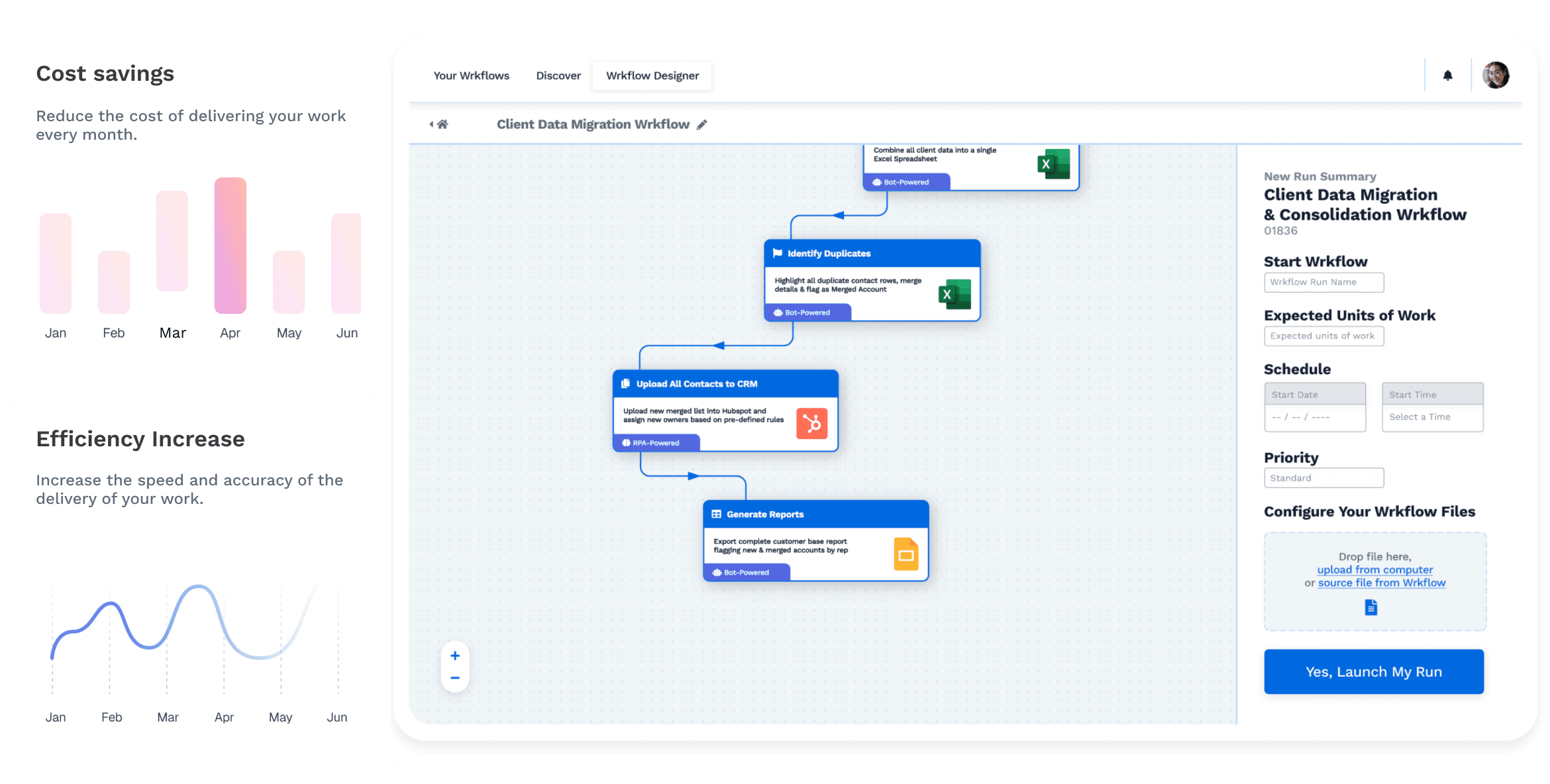

The Wrk Hybrid Automation approach—the first of its kind—is specifically designed to remove tedious, repetitive, and overly time-consuming tasks. The immeasurable gain occurs when the time saved allows your team to focus on high-level, analytical, and forward-thinking, growth-focussed, tasks.

Other key advantages and benefits to adopting automation solutions in your financial reporting processes are:

Quicker approvals. Whether it's reimbursing expenses or approving budgets, many processes can get bogged down or held up by a single person if there's a bottleneck at any step of the process. Automation solutions will help keep the process on track.

Quality control. When documents are coming from several sources and different members of your team (even clients), making sure you don't lose control of the consistency and quality of reporting and documentation is vital. When you add automation to your process, you can also speed up approval and guarantee consistent results.

Reduce margin of error. Even when you try to deliver perfect results, the manual process will always leave more space for mistakes that will require more revision. Automation will help to provide data integrity and more accurate results for reporting.

Reduce fraud and keep track. By adopting financial reporting automation—an objective process—you will reduce the risk of fraud, without needing extra human interaction to compensate. You also can keep track of your data with audit trails and offer transparency to your team, allowing you to pull values, contact information, and even team notes instantly, allowing you to catch errors sooner rather than later.

Saves millions when automating report revenue

Standardizing your process will help you identify what tool is best for your specific and unique revenue-generating cycle. The next step would be to identify which steps of your process can (and should) be automated.

Here are some suggestions:

Year-over-year financial statements;

Quarterly financial statements;

Year-end close;

Financial statement analysis;

Management reporting;

Consolidation purposes;

And much more!

The advantages are measured in financial return as well. A typical firm with $10 billion in revenue could save up to $51 million by realigning finance talent, restructuring the service delivery model and retooling through technology, thereby freeing resources for higher value activity and innovation.

Some other ways that automation solutions can help your organization are through accurate reporting, forecasting, and projecting, and reduced mistakes.

Research shows that world-class finance companies have found that by adding automation to their revenue reporting process, there is a 48% lower error rate than typical companies and the ability to deliver forecasts is 30% faster and with more accuracy.

Give your team more time to analyze results

Manual processes require much more time from your team to focus their attention on perfecting processes, guaranteeing consistency and accuracy, and a step that suffers is the time spent analyzing. Adopting automation solutions for your financial reports frees up your revenue operations teams so they don’t worry so much about creating the reports, but rather can focus on making sense of them.

Finance leaders are improving business results with automation by, amongst other things, spending less time on transactional work. By eliminating inefficiency across many key finance processes, automation and process improvement can reduce costs by up to 46%.

Most automation solutions use RPA and schedule triggers to get the Wrkflows—3-5 tasks from your process—set up to run your cycles while you focus on other tasks. These Wrkflows will start a process whenever you tell them to. For example, Wrk's Accounts Payable, Receivable, & Invoicing Wrkflow allows your business to operate, forecast, and scale. It removes tedious and repetitive steps in your process that are easily automated. You can avoid delays in payments, process invoices quickly, and even automate the emails sent to request payment, which will increase trust and improve the relationship with your partners and clients, as well as save time and money for your team.

What would you do with the cost and time savings?

Learn more about how our Hybrid Automation can help your team collaborate more efficiently, review more accurate data, and save time that you’d otherwise spend looking for mistakes. Read our Revenue-generating eBook here.

Start Automating with Wrk

Kickstart your automation journey with the Wrk all-in-one automation platform