We'll build your

We'll build your

We'll build your

We'll build your

Automation and AI Agents

Automation and AI Agents

Automation and AI Agents

Automation and AI Agents

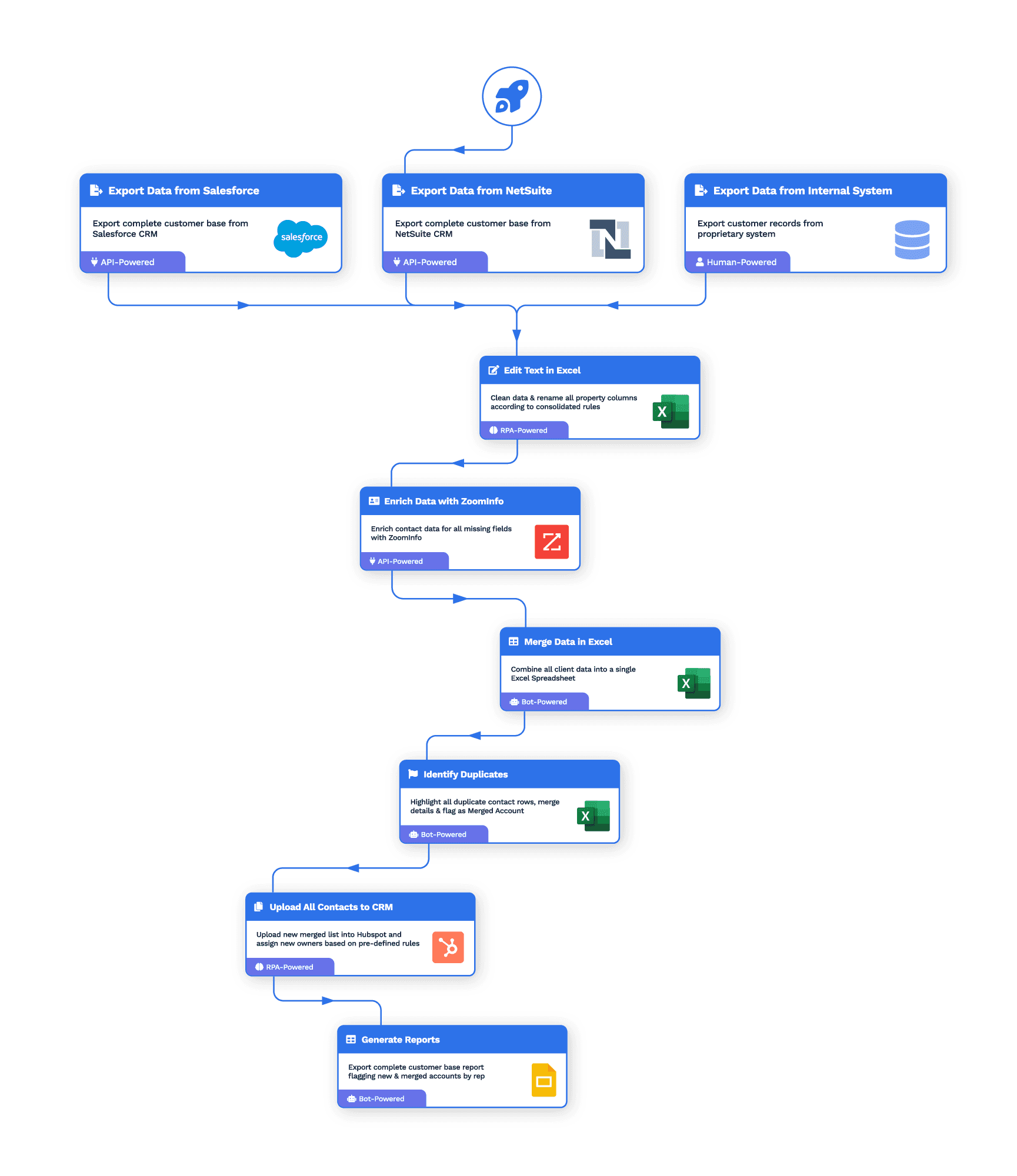

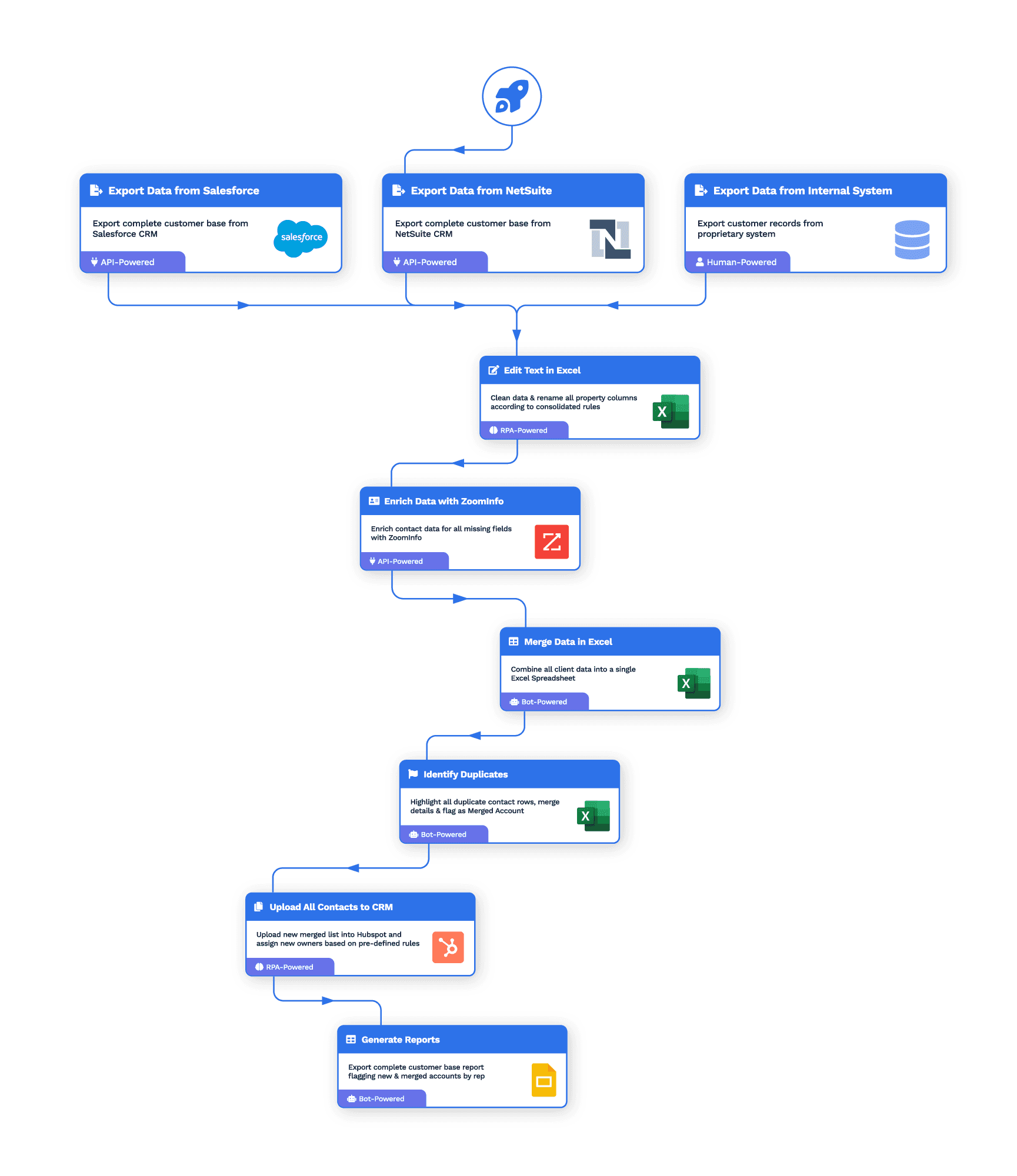

Describe your process, and we’ll build you a fully functional AI Agent or automation using our 2500+ pre-built bots—live within 24 hours.

Trusted by industry leaders like

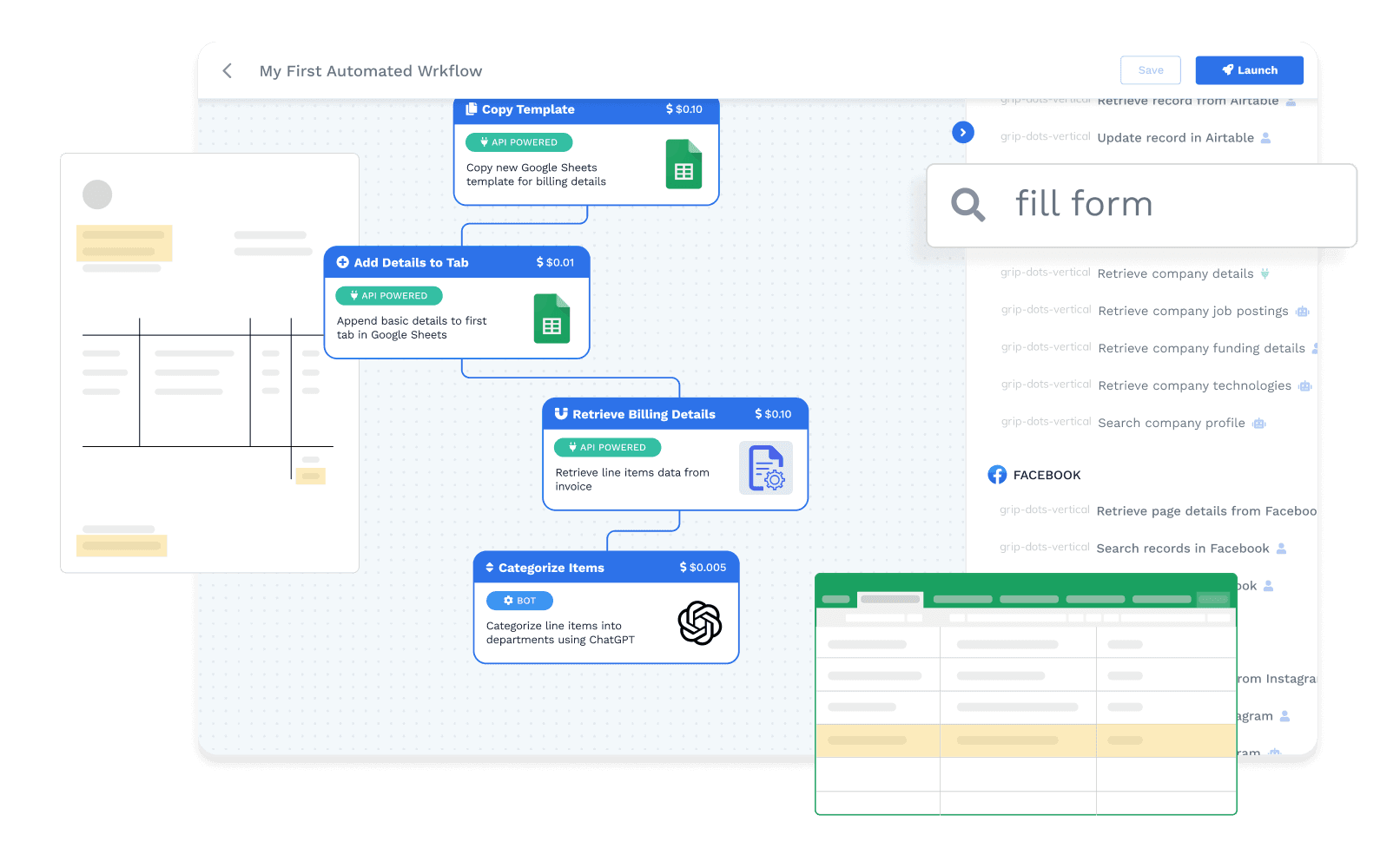

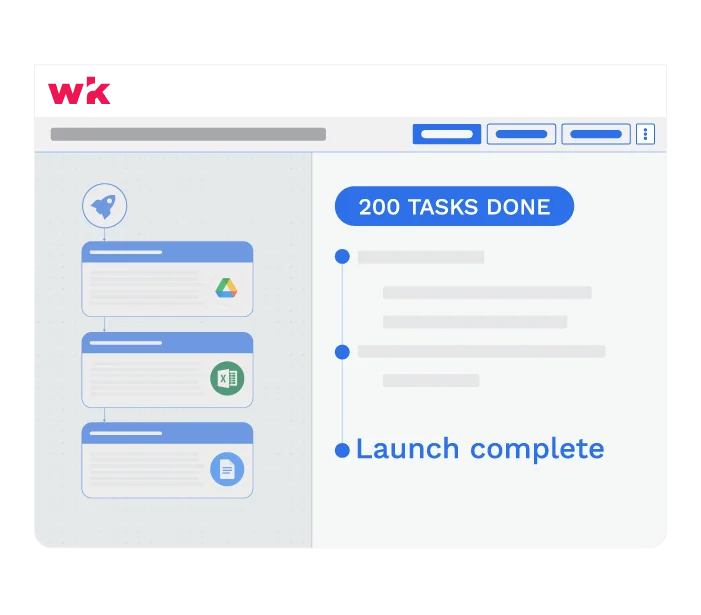

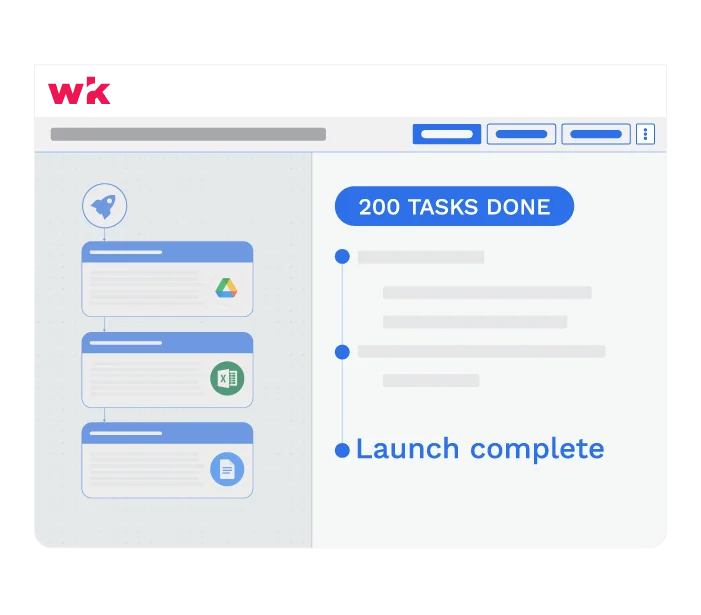

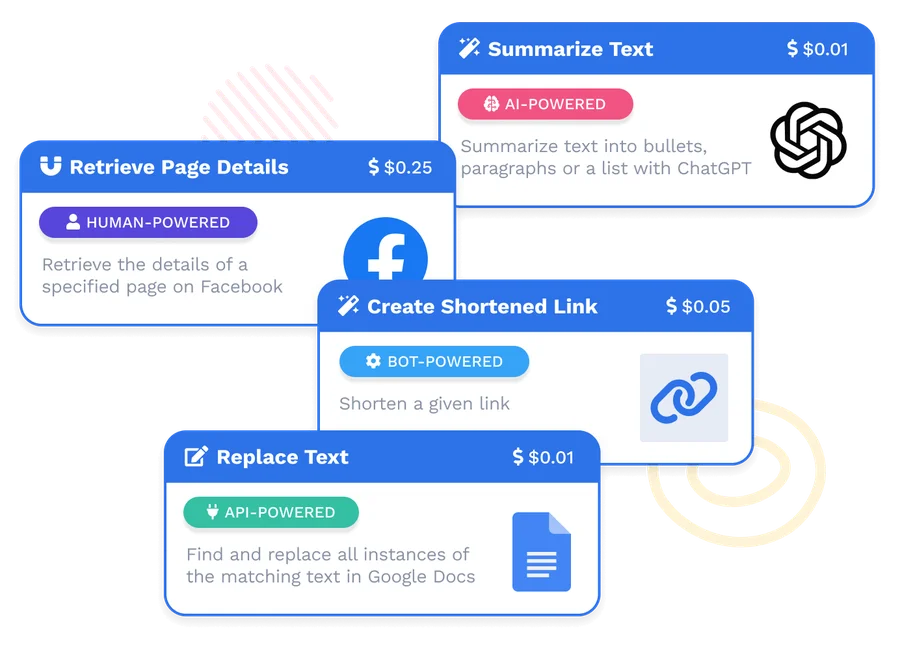

Automate in < 24 hours

Leverage our extensive library of thousands pre-built bots, connectors, and templates to launch your automation workflows in less than a day.

Automate for < $1000

Reduce costs with our one-time workflow setup fees starting at $1000. After that, pay only for what you use with our transaction-based pricing.

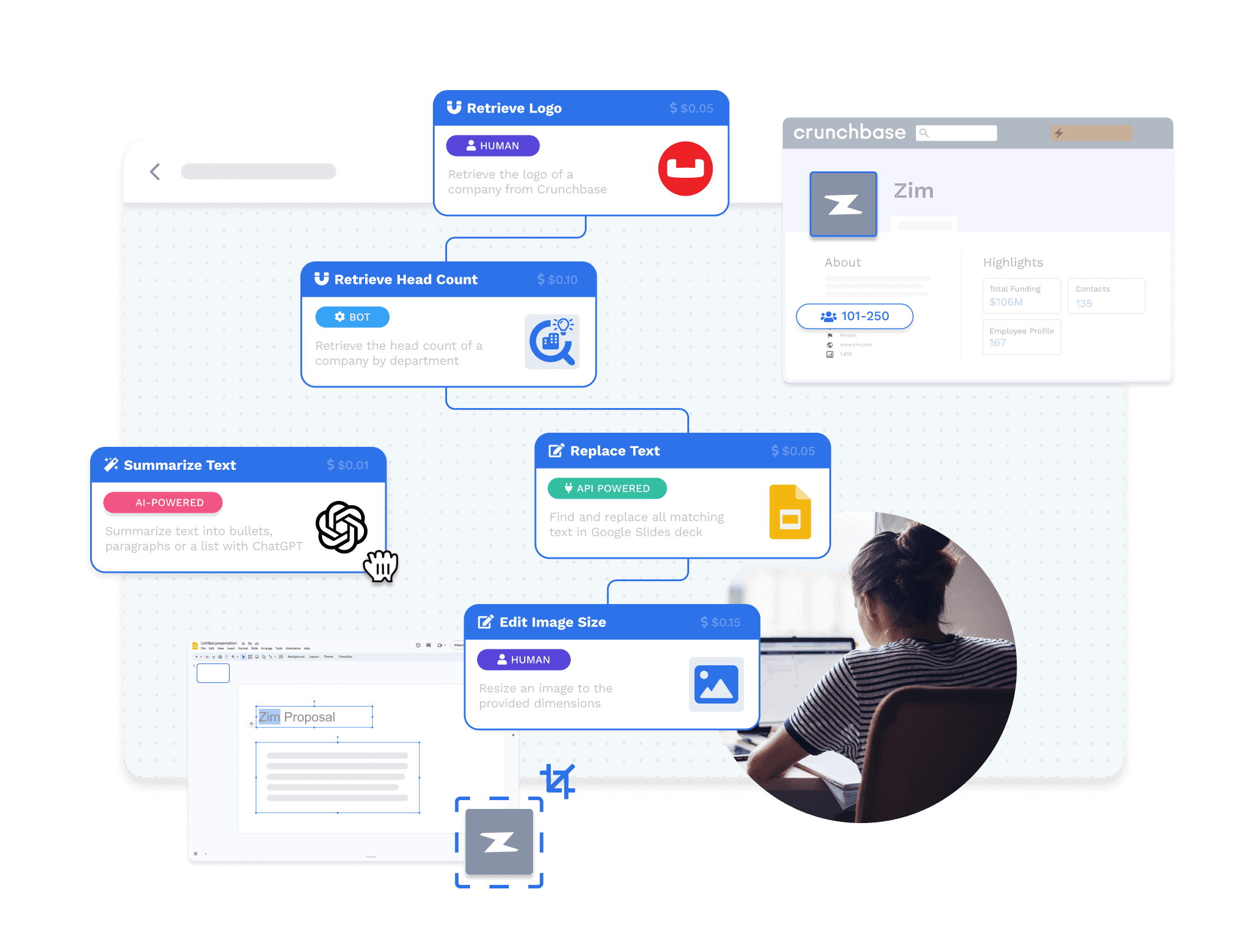

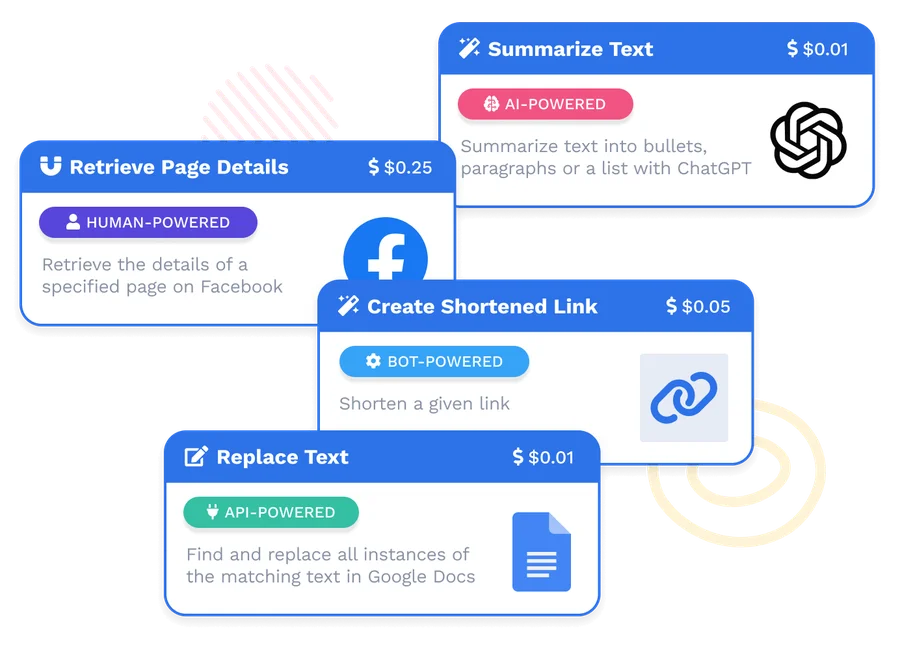

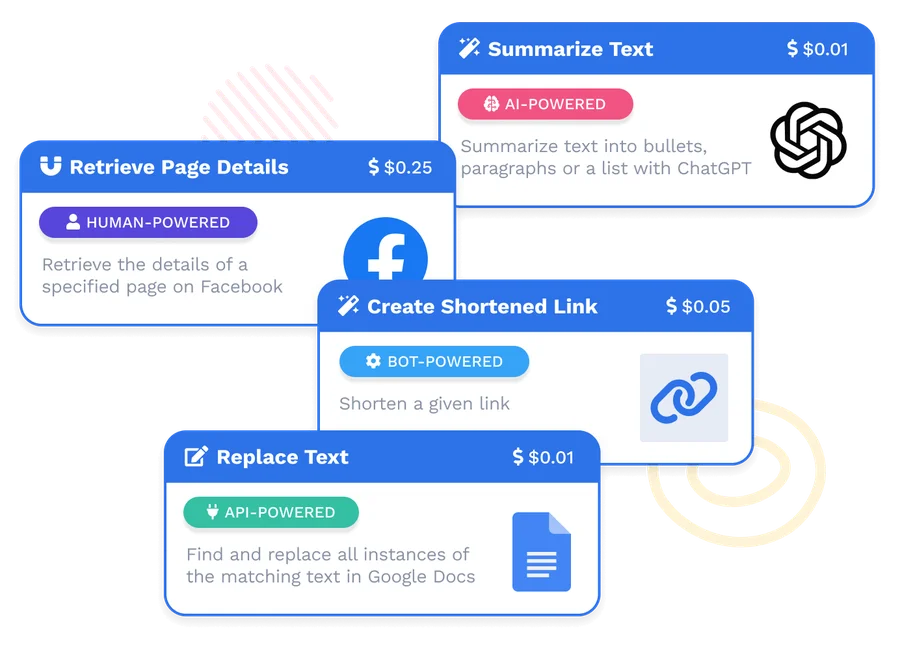

Deploy AI + RPA + OCR + Humans

Solve your automation needs with AI bots, API connectors, document automation, RPA, and human-in-the-loop capabilities all in one place.

Automate in < 24 hours

Leverage our extensive library of thousands pre-built bots, connectors, and templates to launch your automation workflows in less than a day.

Automate for < $1000

Reduce costs with our one-time workflow setup fees starting at $1000. After that, pay only for what you use with our transaction-based pricing.

Deploy AI + RPA + OCR + Humans

Solve your automation needs with AI bots, API connectors, document automation, RPA, and human-in-the-loop capabilities all in one place.

Automate in < 24 hours

Leverage our extensive library of thousands pre-built bots, connectors, and templates to launch your automation workflows in less than a day.

Automate for < $1000

Reduce costs with our one-time workflow setup fees starting at $1000. After that, pay only for what you use with our transaction-based pricing.

Deploy AI + RPA + OCR + Humans

Solve your automation needs with AI bots, API connectors, document automation, RPA, and human-in-the-loop capabilities all in one place.

Automate in < 24 hours

Leverage our extensive library of thousands pre-built bots, connectors, and templates to launch your automation workflows in less than a day.

Automate for < $1000

Reduce costs with our one-time workflow setup fees starting at $1000. After that, pay only for what you use with our transaction-based pricing.

Deploy AI + RPA + OCR + Humans

Solve your automation needs with AI bots, API connectors, document automation, RPA, and human-in-the-loop capabilities all in one place.

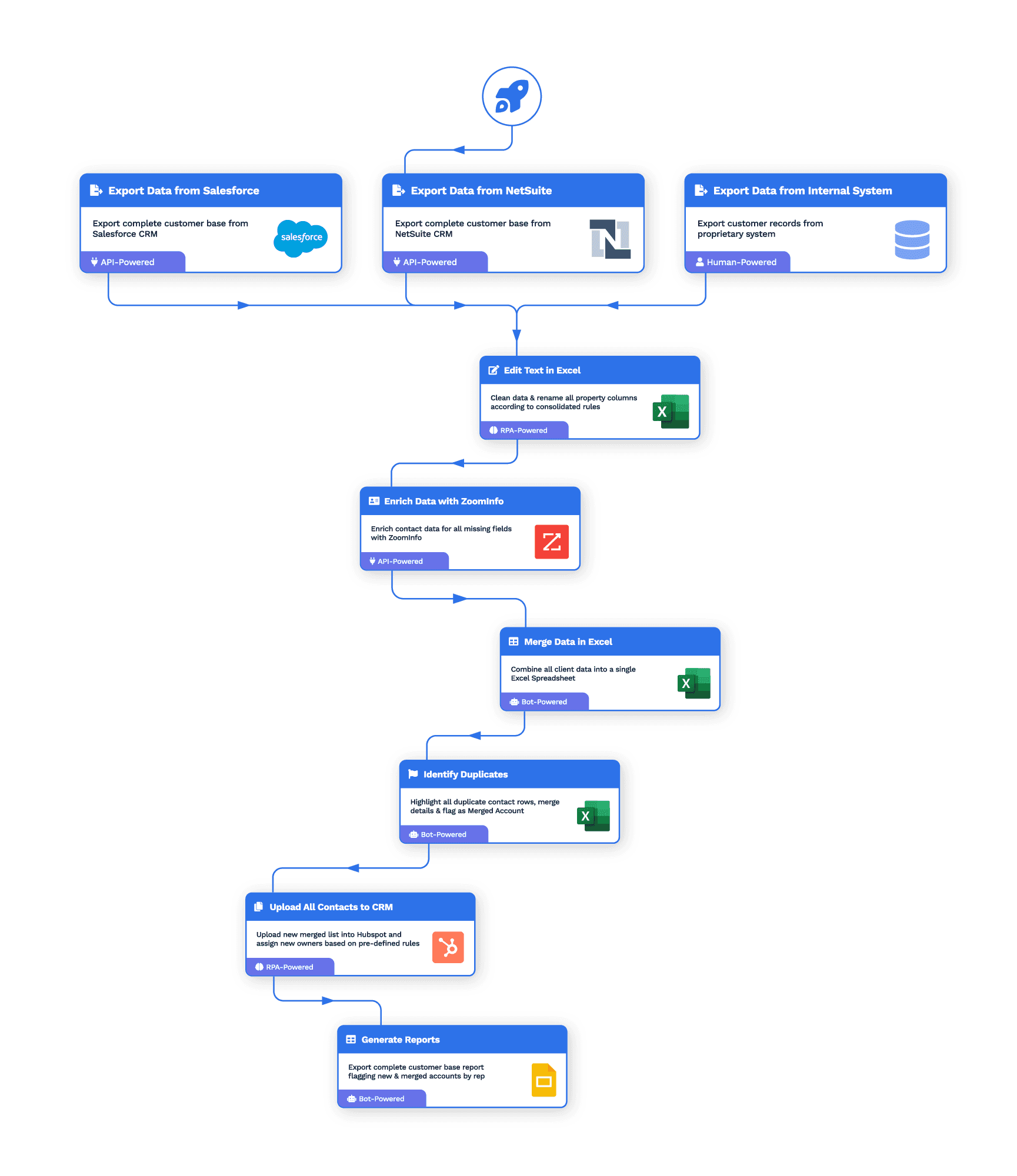

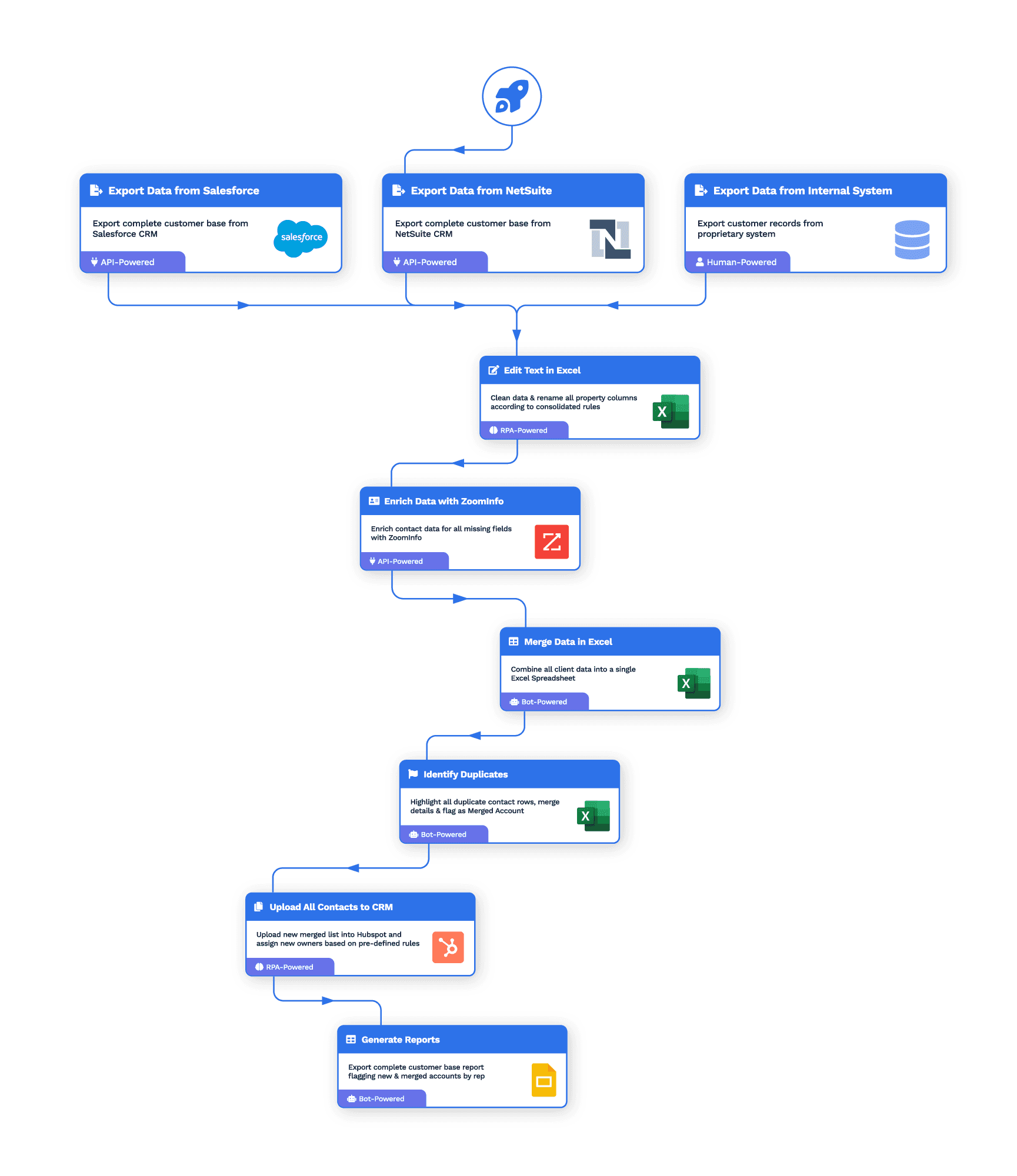

Digitally transform your business with Wrk

Digitally transform your business with Wrk

Digitally transform your business with Wrk

Digitally transform your business with Wrk

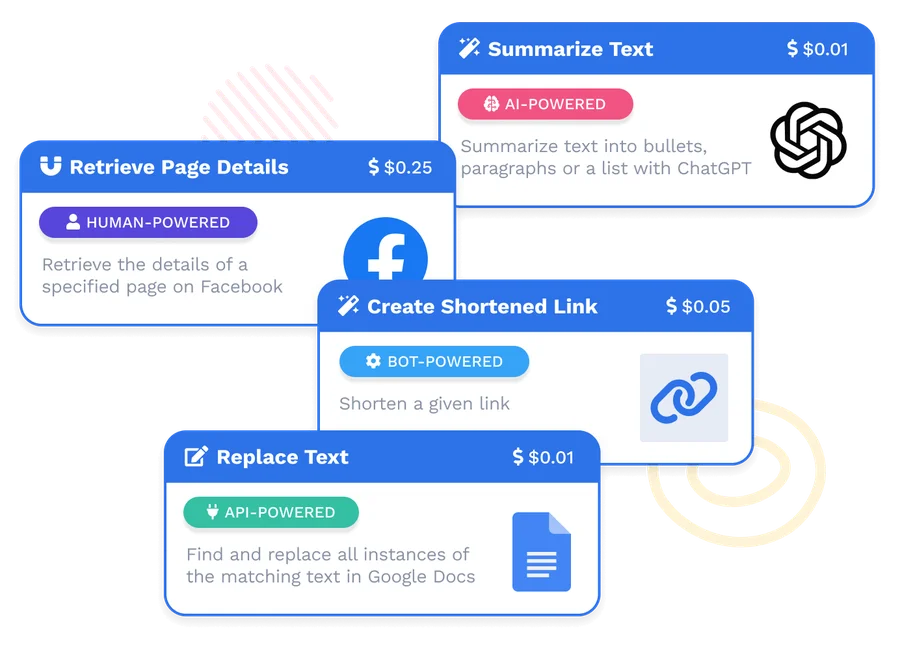

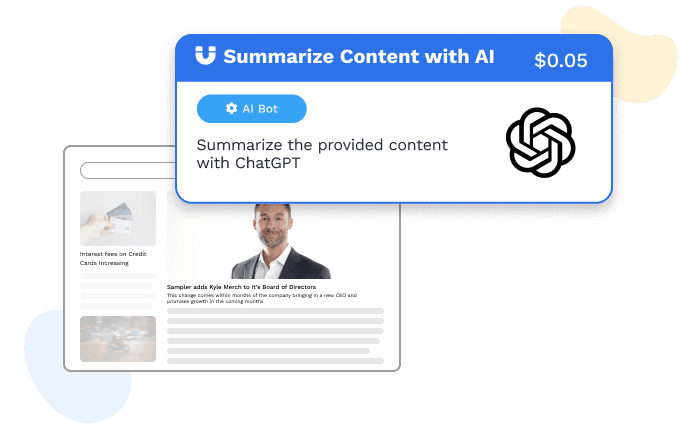

AI Bots

Integrate intelligence like ChatGPT and Anthropic AI into your workflows to automate complex tasks & enhance decision-making within your automation processes.

AI Bots

Integrate intelligence like ChatGPT and Anthropic AI into your workflows to automate complex tasks & enhance decision-making within your automation processes.

AI Bots

Integrate intelligence like ChatGPT and Anthropic AI into your workflows to automate complex tasks & enhance decision-making within your automation processes.

AI Bots

Integrate intelligence like ChatGPT and Anthropic AI into your workflows to automate complex tasks & enhance decision-making within your automation processes.

API Connectors

Seamlessly connect your favorite applications like Salesforce, Slack, and Microsoft 365 into your workflows to streamline data flow and unify your business processes in real time.

API Connectors

Seamlessly connect your favorite applications like Salesforce, Slack, and Microsoft 365 into your workflows to streamline data flow and unify your business processes in real time.

API Connectors

Seamlessly connect your favorite applications like Salesforce, Slack, and Microsoft 365 into your workflows to streamline data flow and unify your business processes in real time.

API Connectors

Seamlessly connect your favorite applications like Salesforce, Slack, and Microsoft 365 into your workflows to streamline data flow and unify your business processes in real time.

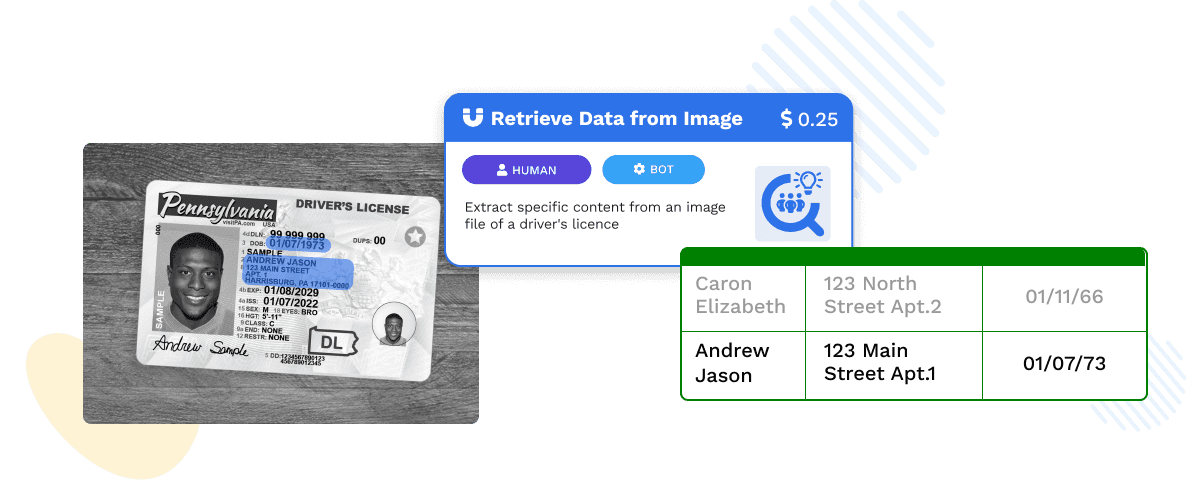

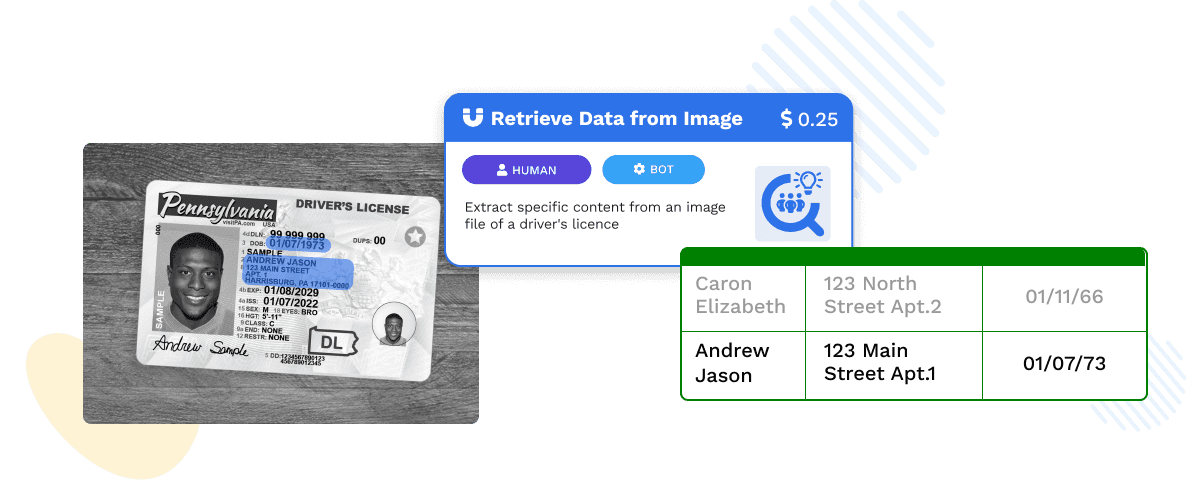

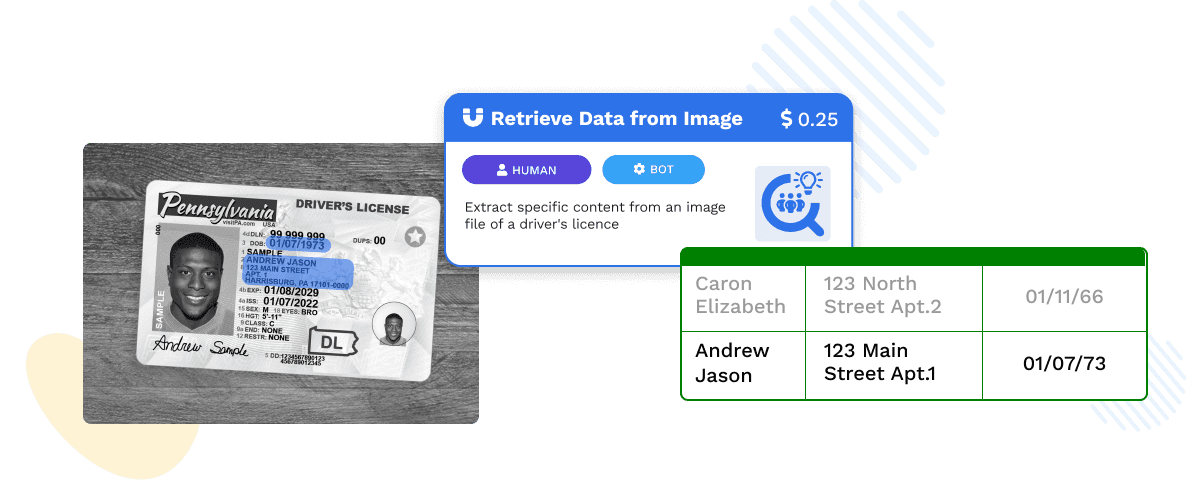

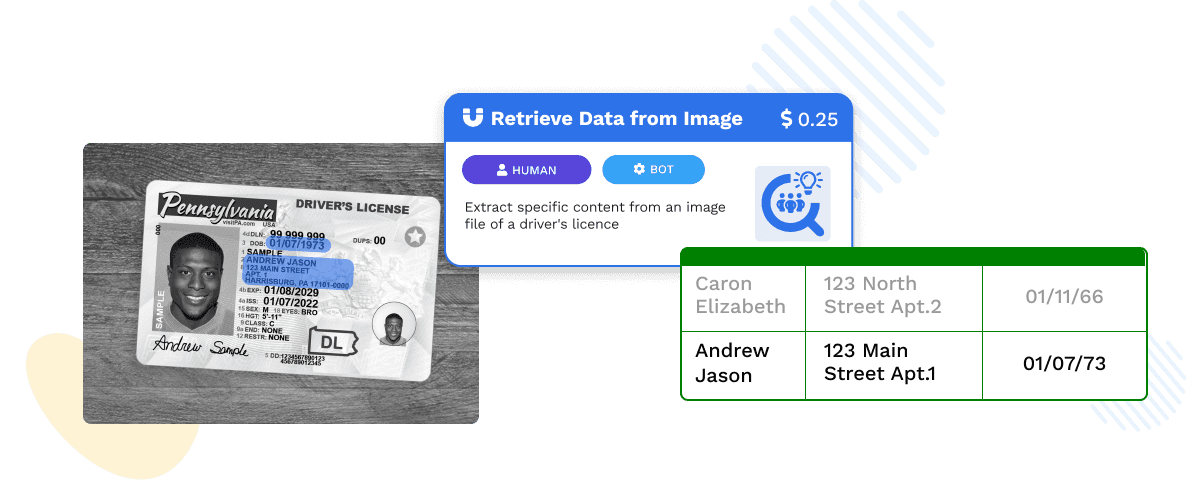

OCR & Document Automation

Automate document processing with advanced tools like Adobe Sign and DocuSign integrated into your workflows. Leverage AI-powered data extraction and OCR technology to handle contracts, invoices, and forms with minimal manual intervention.

OCR & Document Automation

Automate document processing with advanced tools like Adobe Sign and DocuSign integrated into your workflows. Leverage AI-powered data extraction and OCR technology to handle contracts, invoices, and forms with minimal manual intervention.

OCR & Document Automation

Automate document processing with advanced tools like Adobe Sign and DocuSign integrated into your workflows. Leverage AI-powered data extraction and OCR technology to handle contracts, invoices, and forms with minimal manual intervention.

OCR & Document Automation

Automate document processing with advanced tools like Adobe Sign and DocuSign integrated into your workflows. Leverage AI-powered data extraction and OCR technology to handle contracts, invoices, and forms with minimal manual intervention.

RPA + Human-in-the-loop

Combine the power of Robotic Process Automation (RPA) with human expertise. Automate repetitive tasks and incorporate human decision-making where it’s needed most to ensure quality, compliance, and effective exception handling.

RPA + Human-in-the-loop

Combine the power of Robotic Process Automation (RPA) with human expertise. Automate repetitive tasks and incorporate human decision-making where it’s needed most to ensure quality, compliance, and effective exception handling.

RPA + Human-in-the-loop

Combine the power of Robotic Process Automation (RPA) with human expertise. Automate repetitive tasks and incorporate human decision-making where it’s needed most to ensure quality, compliance, and effective exception handling.

RPA + Human-in-the-loop

Combine the power of Robotic Process Automation (RPA) with human expertise. Automate repetitive tasks and incorporate human decision-making where it’s needed most to ensure quality, compliance, and effective exception handling.

SOC 2 Type II certified

Wrk is SOC 2 Type II compliant, ensuring the highest standards of security, availability, and confidentiality for your data.

SOC 2 Type II certified

Wrk is SOC 2 Type II compliant, ensuring the highest standards of security, availability, and confidentiality for your data.

SOC 2 Type II certified

Wrk is SOC 2 Type II compliant, ensuring the highest standards of security, availability, and confidentiality for your data.

SOC 2 Type II certified

Wrk is SOC 2 Type II compliant, ensuring the highest standards of security, availability, and confidentiality for your data.

HIPPA/PIPEDA Compliant

Wrk is HIPAA & PIPEDA compliant, safeguarding protected health information (PHI) to meet stringent healthcare regulations and protect patient privacy.

HIPPA/PIPEDA Compliant

Wrk is HIPAA & PIPEDA compliant, safeguarding protected health information (PHI) to meet stringent healthcare regulations and protect patient privacy.

HIPPA/PIPEDA Compliant

Wrk is HIPAA & PIPEDA compliant, safeguarding protected health information (PHI) to meet stringent healthcare regulations and protect patient privacy.

HIPPA/PIPEDA Compliant

Wrk is HIPAA & PIPEDA compliant, safeguarding protected health information (PHI) to meet stringent healthcare regulations and protect patient privacy.

Managed Services

Let wrk’s team of automation experts build and manage your automation solutions, so you can focus on what matters most.

Managed Services

Let wrk’s team of automation experts build and manage your automation solutions, so you can focus on what matters most.

Managed Services

Let wrk’s team of automation experts build and manage your automation solutions, so you can focus on what matters most.

Managed Services

Let wrk’s team of automation experts build and manage your automation solutions, so you can focus on what matters most.

Use Case

Effortless Intent Based Lead Generation at Scale

Consume intent data on a daily basis and extract leads

HOW WE SOLVED IT FOR THIS CLIENT

100s of fresh leads

every dayChallenges

Time consuming

Our client’s marketing team was manually gathering leadsInefficiency

A lot of time was spent filtering and searching for relevant leads from the data

Scalability Issues

Could only be done ad hoc when someone on the team had timeWrk Automation

Web Process Automation

Process begins everytime a new work assignment is received.

Web Process Automation

Filter the company data based on factors like country and remove previously found companies via Robotic Process Automation (RPA)

Zoominfo connector

Find leads based on the company data from the initial data

API Sync

Add or update leads in client’s marketing tool via API

Impact

Efficiency gain

Time saved from marketing so they can spend more time on more specialized tasks

Effortless scale

Leads delivered daily at scale

Use Case

Automated Invoice Matching for Seamless Reconciliation

Reconcile drop-shipped invoices to the invoices of a distributor

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

invoice reconciliationChallenges

Time consuming

Our client required reconciling invoices they send to clients with the distributor’s invoices for 100’s of invoices a monthInefficiency

A lot of time was spent comparing and collating the information

Scalability Issues

Could only be done ad hoc when someone on the team had timeWrk Automation

Email triggered

Process begins everytime a new email is received.

Optical Character Recognition

Information from every invoice is extracted using OCR

Google Sheets & QuickBooks Online

Invoice data is written into Sheets and matched together with custom formulas, and then sent to QuickBooks Online

Impact

Efficiency gain

Time saved from reading and comparing invoices manually

Effortless scale

Data delivered at scale whenever a new invoice comes in

Use Case

Effortless Document Data Extraction Directly to Spreadsheet

Instantly extract key details from documents and transfer them into structured data

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

data extractionChallenges

Time consuming

Having to extract all the details manually would have taken too much timeInefficiency

PDFs aren't designed for seamless data access

Scalability Issues

Our client required a more holistic view of details about their work from PDF documentsWrk Automation

Email triggered

Process begins everytime a new email is received.

Optical Character Recognition

Information from every document is extracted using OCR

Google Sheets

Data is written in a structured datasheet that allows more analysis to be done

Impact

Efficiency gain

Time saved from having to manually extract details from the documents

Effortless scale

Data delivered at scale whenever a new document comes in

Strategically organized

Data in a structured spreadsheet is easier to manipulate and analyze

Use Case

Streamlined Work Order Responses for Property Management

Enhance your property management efficiency with automated responses to new work orders

HOW WE SOLVED IT FOR THIS CLIENT

Improved efficiency and consistency

Challenges

Time consuming

Manually responding to each work order can be incredibly time-intensive, especially as the volume increases.Human error

Miscommunications, forgotten responses, or missed details can lead to frustrated tenants

Scalability Issues

As work orders pile up, managing everything manually becomes overwhelmingWrk Automation

Email triggered

Process begins everytime a new work order email is received.

Generative AI

Troubleshooting tips are generated based on the work order details

Web Process Automation

A message is sent to the client by automating the work order management website using Robotic Process Automation (RPA)

Impact

Efficiency gain

Fast response times, ensuring work orders are acknowledged and processed quickly without manual intervention

Effortless scale

Data delivered at scale whenever a new work order comes in

Improved Consistency

Automated responses ensure uniformity in communication

Use Case

Auto-Assign Work Orders for Effortless Property Management

Effortlessly delegate tasks with automated work order assignment

HOW WE SOLVED IT FOR THIS CLIENT

Improved efficiency and consistency

Challenges

Time consuming

Manually assigning each work order can be incredibly time-intensive, especially as the volume increases.Inconsistent Data

Information about preferred vendors is different from the work order management software’s information

Scalability Issues

As work orders pile up, managing everything manually becomes overwhelmingWrk Automation

Email triggered

Process begins everytime a new work order email is received.

Generative AI

Does a “fuzzy match” on the name of the vendor on file vs what is found in the property management software

Web Process Automation

The matching name is assigned in the property management software using Robotic Process Automation (RPA)

Impact

Efficiency gain

Fast response times, ensuring work orders are assigned quickly without manual intervention

Effortless scale

Assignment at scale whenever a new work order comes in

Improved Consistency

Work orders are assigned without having to compare names with 100’s of vendors

Use Case

Seamless Payments, Simplified: Automated Reconciliation

Extract transaction data and reconcile against CRM records

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

payment reconciliationChallenges

Manual Data Entry

Time-consuming and prone to errorsDelayed Processing

Delays in reconciling payments can impact cash flow

Inaccurate Designations

Mismatched payment and program information can lead to errorsReport Generation Difficulties

Manual reporting is time-consuming and prone to inaccuraciesWrk Automation

Data sources API

Pulls all transaction and donor data from payment portal

CRM API

Logs all missing gifts via API

Web Process Automation

Updates any gift with an incorrect fund designation via Robotic Process Automation (RPA)

Impact

Efficiency gain

Reduced manual workload, improved processing times

Accuracy

Increased data accuracy and consistency, reduced errors

Insights

Enhanced reporting capabilities for data-driven decision making

Transparency

Improved visibility into donation management processes

Use Case

Synchronized Success: Real-Time Data Synchronization

Synchronize data in real-time between two or more separate systems

HOW WE SOLVED IT FOR THIS CLIENT

Real-time

data synchronization

across multiple systemsChallenges

Manual Data Synchronization

Time-consuming and error-proneDelayed Processing

Mismatched data across systems can lead to inaccuracies

Error Risk

Increased risk of data errors and omissions due to manual processes.Inefficient Resource Allocation

Significant time and effort spent on data managementWrk Automation

Webhooks

Webhook calls are received whenever a change is made to an opportunity

API Connectors

Locate the equivalent record in the other system, and add/update the record via API

Impact

Efficiency

Reduced manual workload, improved productivity

Accuracy

Enhanced data consistency and accuracy, reduced errors

Security

Improved security by reducing the need for multiple teams to access systems.

Operational Efficiency

Streamlined workflows and improved decision-making

Use Case

Streamlined Admissions: Automated Data Verification

Extract data from documents, verify against applicant information, and update records

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and complete applicant data, streamlined admissions process

Challenges

Manual Data Entry

Time-consuming and prone to errorsInefficient Document Verification

Slow and error-prone manual processes

Low-Quality Images

Poor image quality can hinder data extractionData Inconsistency

Mismatched data across systems can lead to inaccuraciesWrk Automation

Webhooks

Webhook calls are received whenever a student application is received

Optical Character Recognition

Verifies document image quality and extracts information from submitted documents using OCRAPI Connectors

Compare existing record data and update any discrepancies via API

Impact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Enhanced data accuracy and consistency, reduced errors

Quality

Improved document quality and legibility

Applicant Experience

Faster processing times and improved satisfaction

Use Case

Dynamic Reports, Delivered: Automated PDF Generation

Generate custom PDF reports based on dynamic templates and data

HOW WE SOLVED IT FOR THIS CLIENT

Personalized and professional reports at scale, delivered automatically

Challenges

Manual Report Recreation

Time-consuming and error-proneData Gathering

Difficulty collecting and compiling accurate data

Inconsistent Layout

Maintaining consistent report layout and content can be challengingScalability Issues

Difficulty scaling reporting as the donor base growsWrk Automation

Human in the loop

Humans retrieve images for the reports based on strict criteria

API Connectors

Extract report data from source platform via API, and dynamically customize each report’s content and layout

Impact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Enhanced data accuracy and consistency, reduced errors

Scalability

Increased efficiency and scalability of reporting processes

Timeliness

Ability to provide donors with timely updates on the impact of their donations

Use Case

Receipting Made Easy: Automated, Accurate, Efficient

Verify addresses and issue official donation receipts automatically

HOW WE SOLVED IT FOR THIS CLIENT

20,000+ receipts

automatically deliveredChallenges

Manual Address Verification

Time-consuming and error-proneInefficient Receipt Issuance

Slow and manual processes

Inaccurate Addresses

Incorrect addresses can lead to undelivered receiptsScalability Issues

Difficulty handling large volumes of receipts.Wrk Automation

API Connectors

Extract all donor in CRM database via API, verify each donor’s address, and dynamically generates each individual receipt

Gmail API

Sends each individual donor’s receipt via API

Impact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Enhanced address accuracy, reduced errors

Scalability

Increased efficiency and scalability for handling large volumes of receipts

Timeliness

Timely receipt issuance, improved donor satisfaction

Use Case

Skin Analysis Simplified: Personalized Treatment Recommendations

Analyze skin images, provide treatment recommendations, and send notifications

HOW WE SOLVED IT FOR THIS CLIENT

Instant and accurate analysis and treatment recommendations

Challenges

Manual Analysis

Time-consuming and subjectivenaccurate Assessments

Manual assessments can be prone to errors

Limited Personalization

Difficulty providing personalized treatment recommendationsInefficient Communication

Inefficient Communication: Delayed or inconsistent communication with patientsWrk Automation

Webhooks

Webhook calls are received whenever a patient submits an image of themselves

AI bots

Perform multiple different analyses of the imageAPI Connectors

Generate and send results to patient in an email, SMS message, and voicemail

Impact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Improved accuracy of skin analysis and recommendations

Personalization

Tailored treatment recommendations for individual patients

Communication

Improved patient communication and engagement

Use Case

Turn Conversations into Tickets: Automated Ticket Creation

Convert Slack messages into tickets and assign to appropriate teams

HOW WE SOLVED IT FOR THIS CLIENT

Efficient ticket management, improved response times, enhanced customer satisfaction

Challenges

Manual Ticket Creation

Time-consuming and error-proneDelayed Responses

Delayed response times to customer inquiries

Inconsistent Tracking

Difficulty tracking and managing customer requestsInefficient Communication

Inefficient communication channels can lead to customer dissatisfactionWrk Automation

Webhooks

Webhook calls are received whenever a customer messages a Slack channel

API Connectors

Extract the Slack user’s details and the request details

API Connectors

Create, via API, the request in the ticketing system, and the original Slack message is reacted to to acknowledge the reception of the request

Impact

Efficiency

Reduced manual workload, improved response times

Organization

Streamlined ticket management, improved tracking

Communication

Improved communication and collaboration between teams

Customer Satisfaction

Enhanced customer satisfaction through timely responses

Use Case

Fuel Your AI: Automated Data Extraction and Preparation

Extract data, prepare for AI training, and deliver to model

HOW WE SOLVED IT FOR THIS CLIENT

Clean, structured data for AI model training, accelerated insights

Challenges

Manual Data Extraction

Time-consuming and error-proneInconsistent Data

Data from SEC filings is inconsistently formatted and difficult to processData Preparation

Preparing data for AI training can be complex and time-consumingScalability Issues

Difficulty handling large volumes of dataWrk Automation

Web Process Automation

Pulls a list of the current S&P 500 companies via Robotic Process AutomationSEC EDGAR Filings API

Retrieves each company’s latest 10-K documentHuman in the loop

Humans meticulously extracts each individual risk factor found in each 10-K document

API Sync

Summarize each individual risk factor section and convert to JSON

Gmail API

Delivers the outputted JSON file to the client for upload into AI model

Impact

Efficiency

Reduced manual workload, improved processing times

Accuracy

mproved data accuracy and consistency

Scalability

Increased efficiency and scalability for handling large datasets

AI Model Performance

High-quality data can improve AI model performance

Use Case

Effortless Intent Based Lead Generation at Scale

Consume intent data on a daily basis and

extract leadsHOW WE SOLVED IT FOR THIS CLIENT

100s of fresh leads

every dayChallenges

Time consuming

Our client’s marketing team manually getting leads from their G2 dataInefficiency

A lot of time was spent filtering and searching for relevant leads from the data

Scalability Issues

Could only be done ad hoc when someone on the team had timeImpact

Efficiency gain

Time saved from marketing so they can spend more time on more specialized tasks

Effortless scale

Leads delivered daily at scale

Wrk Automation

Web Process Automation

Process begins everytime a new work assignment is received.

Web Process Automation

Filter the company data based on factors like country and remove previously found companies

Zoominfo Wrk Action

Find leads based on the company data from the initial data

API Sync

add or update leads in client’s marketing tool

Use Case

Automated Invoice Matching

for Seamless ReconciliationReconcile drop-shipped invoices to the invoices of a distributor

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

invoice reconciliation

Challenges

Time consuming

Our client required reconciling invoices they send to clients with the distributor’s invoices for 100’s of invoices a monthInefficiency

A lot of time was spent comparing and collating the information

Scalability Issues

Could only be done ad hoc when someone on the team had timeImpact

Efficiency gain

Time saved from reading and comparing invoices manually

Effortless scale

Data delivered at scale whenever a new invoice comes in

Wrk Automation

Email triggered

Process begins everytime a new email is received.

Optical Character Recognition

Information from every invoice is extracted using OCR

Google Sheets

Invoice data is written into Sheets and matched together with custom formulas

Use Case

Effortless Intent Based Lead Generation at Scale

Consume intent data on a daily basis and

extract leadsHOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

data extractionChallenges

Time consuming

Having to extract all the details manually would have taken too much timeInefficiency

PDFs aren't designed for seamless data access

Scalability Issues

Our client required a more holistic view of details about their work from PDF documentsImpact

Efficiency gain

Time saved from having to manually extract details from the documents

Effortless scale

Data delivered at scale whenever a new document comes in

Strategically organized

Data in a structured spreadsheet is easier to manipulate and analyze

Wrk Automation

Email triggered

Process begins everytime a new email is received.

Optical Character Recognition

Information from every document is extracted using OCR

Google Sheets

Data is written in a structured datasheet that allows more analysis to be done

Use Case

Streamlined Work Order Responses for Property Management

Enhance your property management efficiency with automated responses to new work orders

HOW WE SOLVED IT FOR THIS CLIENT

Improved efficiency and consistency

Challenges

Time consuming

Manually responding to each work order can be incredibly time-intensive, especially as the volume increases.Human Error

Miscommunications, forgotten responses, or missed details can lead to frustrated tenant

Scalability Issues

As work orders pile up, managing everything manually becomes overwhelmingImpact

Efficiency gain

Fast response times, ensuring work orders are acknowledged and processed quickly without manual intervention

Effortless scale

Data delivered at scale whenever a new work order comes in

Strategically organized

Data in a structured spreadsheet is easier to manipulate and analyze

Wrk Automation

Email triggered

Process begins everytime a new work order email is received.

Generative AI

Troubleshooting tips are generated based on the work order details

Web Process Automation

A message is sent to the client by automating the work order management website

Use Case

Auto-Assign Work Orders for Effortless Property Management

Effortlessly delegate tasks with automated work

order assignmentHOW WE SOLVED IT FOR THIS CLIENT

Improved efficiency and consistency

Challenges

Time consuming

Manually assigning each work order can be incredibly time-intensive, especially as the volume increases.Inconsistent Data

Information about preferred vendors is different from the work order management software’s information

Scalability Issues

As work orders pile up, managing everything manually becomes overwhelmingImpact

Efficiency gain

Fast response times, ensuring work orders are assigned quickly without manual intervention

Effortless scale

Assignment at scale whenever a new work order comes in

Improved Consistency

Work orders are assigned without having to compare names with 100’s of vendorsWrk Automation

Email triggered

Process begins everytime a new work order email is received.

Generative AI

Does a “fuzzy match” on the name of the vendor on file vs what is found in the property management softwareWeb Process Automation

The matching name is assigned in the property management softwareUse Case

Seamless Payments, Simplified: Automated Reconciliation

Extract transaction data and reconcile against CRM records

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

payment reconciliationChallenges

Manual Data Entry

Time-consuming and prone to errorsDelayed Processing

Delays in reconciling payments can impact cash flow

Inaccurate Designations

Mismatched payment and program information can lead to errorsReport Generation Difficulties

Manual reporting is time-consuming and prone to inaccuraciesImpact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Increased data accuracy and consistency, reduced errors

Insights

Enhanced reporting capabilities for data-driven decision makingTransparency

Improved visibility into donation management processes

Wrk Automation

Data sources API

Pulls all transaction and donor data from payment portal

CRM API

Logs all missing giftsWeb Process Automation

updates any gift with an incorrect fund designationUse Case

Synchronized Success: Real-Time Data Synchronization

Synchronize data in real-time between two or more separate systems

HOW WE SOLVED IT FOR THIS CLIENT

Real-time data

synchronization

across multiple systemsChallenges

Manual Data Synchronization

Time-consuming and prone to errorsData Inconsistency

Mismatched data across systems can lead to inaccuraciesError Risk

Increased risk of data errors and omissions due to manual processes.Inefficient Resource Allocation

Significant time and effort spent on data managementImpact

Efficiency

Reduced manual workload, improved productivity

Accuracy

Enhanced data consistency and accuracy, reduced errors

Security

Improved security by reducing the need for multiple teams to access systems.Operational Efficiency

Streamlined workflows and improved decision-making

Wrk Automation

Webhooks

are received whenever a change is made to an opportunity

API Connectors

Locate the equivalent record in the other system, and add/update the recordUse Case

Streamlined Admissions: Automated Data Verification

Extract data from documents, verify against applicant information, and update records

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and complete applicant data, streamlined admissions process

Challenges

Manual Data Entry

Time-consuming and prone to errorsInefficient Document Verification

Slow and error-prone manual processesLow-Quality Images

Poor image quality can hinder data extractionData Inconsistency

Mismatched data across systems can lead to inaccuraciesImpact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Enhanced data accuracy and consistency, reduced errors

Quality

Improved document quality and legibilityApplicant Experience

Faster processing times and improved satisfaction

Wrk Automation

Webhooks

are received whenever a student application is received

Optical Character Recognition

verifies document image quality and extracts information from submitted documentsAPI Connectors

compare existing record data and update any discrepanciesUse Case

Dynamic Reports, Delivered: Automated PDF Generation

Generate custom PDF reports based on dynamic templates and data

HOW WE SOLVED IT FOR THIS CLIENT

Personalized and professional reports at scale, delivered automatically

Challenges

Manual Report Creation

Time-consuming and error-proneData Gathering

Difficulty collecting and compiling accurate dataInconsistent Layout

Maintaining consistent report layout and content can be challengingScalability Issues

Difficulty scaling reporting as the donor base growsImpact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Enhanced data accuracy and consistency, reduced errorsScalability

Increased efficiency and scalability of reporting processesTimeliness

Ability to provide donors with timely updates on the impact of their donationsWrk Automation

Human in the loop

retrieves images for the reports based on strict criteriaAPI Connectors

extract report data from source platform, and dynamically customize each report’s content and layoutUse Case

Receipting Made Easy: Automated, Accurate, Efficient

Verify addresses and issue official donation receipts automatically

HOW WE SOLVED IT FOR THIS CLIENT

20,000+ receipts

automatically deliveredChallenges

Manual Address Verification

Time-consuming and error-proneInefficient Receipt Issuance

Slow and manual processesInaccurate Addresses

Incorrect addresses can lead to undelivered receiptsScalability Issues

Difficulty handling large volumes of receipts.Impact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Enhanced data accuracy, reduced errorsScalability

Increased efficiency and scalability for handling large volumes of receiptsTimeliness

Aimely receipt issuance, improved donor satisfactionWrk Automation

API Connectors

extract all donor in CRM database, verify each donor’s address, and dynamically generates each individual receiptGmail API

sends each individual donor’s receiptUse Case

Skin Analysis Simplified: Personalized Treatment Recommendations

Analyze skin images, provide treatment recommendations, and send notifications

HOW WE SOLVED IT FOR THIS CLIENT

Instant and accurate analysis and treatment recommendations

Challenges

Manual Analysis

Time-consuming and subjectiveInaccurate Assessments

Manual assessments can be prone to errorsLimited Personalization

Difficulty providing personalized treatment recommendationsInefficient Communication

Inefficient Communication: Delayed or inconsistent communication with patientsImpact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Improved accuracy of skin analysis and recommendationsPersonalization

Tailored treatment recommendations for individual patientsCommunication

Improved patient communication and engagementWrk Automation

Webhooks

are received whenever a patient submits an image of themselvesAI bots

perform multiple different analyses of the imageAPI Connectors

generate and send results to patient in an email, SMS message, and voicemailUse Case

Turn Conversations into Tickets: Automated Ticket Creation

Convert Slack messages into tickets and assign to appropriate teams

HOW WE SOLVED IT FOR THIS CLIENT

Efficient ticket management, improved response times, enhanced customer satisfaction

Challenges

Manual Ticket Creation

Time-consuming and error-proneDelayed Responses

Delayed response times to customer inquiriesInconsistent Tracking

Difficulty tracking and managing customer requestsInefficient Communication

Inefficient communication channels can lead to customer dissatisfactionImpact

Efficiency

Reduced manual workload, improved response timesOrganization

Streamlined ticket management, improved trackingCommunication

Improved communication and collaboration between teamsCustomer Satisfaction

Enhanced customer satisfaction through timely responsesWrk Automation

Webhooks

are received whenever a customer messages a Slack channelAPI Connectors

extract the Slack user’s details and the request detailsAPI Connectors

create the request in the ticketing system, and the original Slack message is reacted to to acknowledge the reception of the requestUse Case

Fuel Your AI: Automated Data Extraction and Preparation

Extract data, prepare for AI training, and deliver

to modelHOW WE SOLVED IT FOR THIS CLIENT

Clean, structured data for AI model training, accelerated insights

Challenges

Manual Data Extraction

Time-consuming and error-proneInconsistent Data

Data from SEC filings is inconsistently formatted and difficult to processData Preparation

Preparing data for AI training can be complex and time-consumingScalability Issues

Difficulty handling large volumes of dataImpact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Improved data accuracy and consistencyScalability

Increased efficiency and scalability for handling large datasetsAI Model Performance

High-quality data can improve AI model performanceWrk Automation

Web Process Automation

pulls a list of the current S&P 500 companiesSEC EDGAR Filings API

retrieves each company’s latest 10-K documentHuman in the loop

meticulously extracts each individual risk factor found in each 10-K documentAI bots

summarize each individual risk factor section and convert to JSONGmail API

delivers the outputted JSON file to the client for upload into AI model

Use Case

Effortless Intent Based Lead Generation at Scale

Consume intent data on a daily basis and

extract leadsHOW WE SOLVED IT FOR THIS CLIENT

100s of fresh leads

every dayChallenges

Time consuming

Our client’s marketing team manually getting leads from their G2 dataInefficiency

A lot of time was spent filtering and searching for relevant leads from the data

Scalability Issues

Could only be done ad hoc when someone on the team had timeImpact

Efficiency gain

Time saved from marketing so they can spend more time on more specialized tasks

Effortless scale

Leads delivered daily at scale

Wrk Automation

Web Process Automation

Process begins everytime a new work assignment is received.

Web Process Automation

Filter the company data based on factors like country and remove previously found companies

Zoominfo Wrk Action

Find leads based on the company data from the initial data

API Sync

add or update leads in client’s marketing tool

Use Case

Automated Invoice Matching

for Seamless ReconciliationReconcile drop-shipped invoices to the invoices of a distributor

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

invoice reconciliation

Challenges

Time consuming

Our client required reconciling invoices they send to clients with the distributor’s invoices for 100’s of invoices a monthInefficiency

A lot of time was spent comparing and collating the information

Scalability Issues

Could only be done ad hoc when someone on the team had timeImpact

Efficiency gain

Time saved from reading and comparing invoices manually

Effortless scale

Data delivered at scale whenever a new invoice comes in

Wrk Automation

Email triggered

Process begins everytime a new email is received.

Optical Character Recognition

Information from every invoice is extracted using OCR

Google Sheets

Invoice data is written into Sheets and matched together with custom formulas

Use Case

Effortless Intent Based Lead Generation at Scale

Consume intent data on a daily basis and

extract leadsHOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

data extractionChallenges

Time consuming

Having to extract all the details manually would have taken too much timeInefficiency

PDFs aren't designed for seamless data access

Scalability Issues

Our client required a more holistic view of details about their work from PDF documentsImpact

Efficiency gain

Time saved from having to manually extract details from the documents

Effortless scale

Data delivered at scale whenever a new document comes in

Strategically organized

Data in a structured spreadsheet is easier to manipulate and analyze

Wrk Automation

Email triggered

Process begins everytime a new email is received.

Optical Character Recognition

Information from every document is extracted using OCR

Google Sheets

Data is written in a structured datasheet that allows more analysis to be done

Use Case

Streamlined Work Order Responses for Property Management

Enhance your property management efficiency with automated responses to new work orders

HOW WE SOLVED IT FOR THIS CLIENT

Improved efficiency and consistency

Challenges

Time consuming

Manually responding to each work order can be incredibly time-intensive, especially as the volume increases.Human Error

Miscommunications, forgotten responses, or missed details can lead to frustrated tenant

Scalability Issues

As work orders pile up, managing everything manually becomes overwhelmingImpact

Efficiency gain

Fast response times, ensuring work orders are acknowledged and processed quickly without manual intervention

Effortless scale

Data delivered at scale whenever a new work order comes in

Strategically organized

Data in a structured spreadsheet is easier to manipulate and analyze

Wrk Automation

Email triggered

Process begins everytime a new work order email is received.

Generative AI

Troubleshooting tips are generated based on the work order details

Web Process Automation

A message is sent to the client by automating the work order management website

Use Case

Auto-Assign Work Orders for Effortless Property Management

Effortlessly delegate tasks with automated work

order assignmentHOW WE SOLVED IT FOR THIS CLIENT

Improved efficiency and consistency

Challenges

Time consuming

Manually assigning each work order can be incredibly time-intensive, especially as the volume increases.Inconsistent Data

Information about preferred vendors is different from the work order management software’s information

Scalability Issues

As work orders pile up, managing everything manually becomes overwhelmingImpact

Efficiency gain

Fast response times, ensuring work orders are assigned quickly without manual intervention

Effortless scale

Assignment at scale whenever a new work order comes in

Improved Consistency

Work orders are assigned without having to compare names with 100’s of vendorsWrk Automation

Email triggered

Process begins everytime a new work order email is received.

Generative AI

Does a “fuzzy match” on the name of the vendor on file vs what is found in the property management softwareWeb Process Automation

The matching name is assigned in the property management softwareUse Case

Seamless Payments, Simplified: Automated Reconciliation

Extract transaction data and reconcile against CRM records

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

payment reconciliationChallenges

Manual Data Entry

Time-consuming and prone to errorsDelayed Processing

Delays in reconciling payments can impact cash flow

Inaccurate Designations

Mismatched payment and program information can lead to errorsReport Generation Difficulties

Manual reporting is time-consuming and prone to inaccuraciesImpact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Increased data accuracy and consistency, reduced errors

Insights

Enhanced reporting capabilities for data-driven decision makingTransparency

Improved visibility into donation management processes

Wrk Automation

Data sources API

Pulls all transaction and donor data from payment portal

CRM API

Logs all missing giftsWeb Process Automation

updates any gift with an incorrect fund designationUse Case

Synchronized Success: Real-Time Data Synchronization

Synchronize data in real-time between two or more separate systems

HOW WE SOLVED IT FOR THIS CLIENT

Real-time data

synchronization

across multiple systemsChallenges

Manual Data Synchronization

Time-consuming and prone to errorsData Inconsistency

Mismatched data across systems can lead to inaccuraciesError Risk

Increased risk of data errors and omissions due to manual processes.Inefficient Resource Allocation

Significant time and effort spent on data managementImpact

Efficiency

Reduced manual workload, improved productivity

Accuracy

Enhanced data consistency and accuracy, reduced errors

Security

Improved security by reducing the need for multiple teams to access systems.Operational Efficiency

Streamlined workflows and improved decision-making

Wrk Automation

Webhooks

are received whenever a change is made to an opportunity

API Connectors

Locate the equivalent record in the other system, and add/update the recordUse Case

Streamlined Admissions: Automated Data Verification

Extract data from documents, verify against applicant information, and update records

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and complete applicant data, streamlined admissions process

Challenges

Manual Data Entry

Time-consuming and prone to errorsInefficient Document Verification

Slow and error-prone manual processesLow-Quality Images

Poor image quality can hinder data extractionData Inconsistency

Mismatched data across systems can lead to inaccuraciesImpact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Enhanced data accuracy and consistency, reduced errors

Quality

Improved document quality and legibilityApplicant Experience

Faster processing times and improved satisfaction

Wrk Automation

Webhooks

are received whenever a student application is received

Optical Character Recognition

verifies document image quality and extracts information from submitted documentsAPI Connectors

compare existing record data and update any discrepanciesUse Case

Dynamic Reports, Delivered: Automated PDF Generation

Generate custom PDF reports based on dynamic templates and data

HOW WE SOLVED IT FOR THIS CLIENT

Personalized and professional reports at scale, delivered automatically

Challenges

Manual Report Creation

Time-consuming and error-proneData Gathering

Difficulty collecting and compiling accurate dataInconsistent Layout

Maintaining consistent report layout and content can be challengingScalability Issues

Difficulty scaling reporting as the donor base growsImpact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Enhanced data accuracy and consistency, reduced errorsScalability

Increased efficiency and scalability of reporting processesTimeliness

Ability to provide donors with timely updates on the impact of their donationsWrk Automation

Human in the loop

retrieves images for the reports based on strict criteriaAPI Connectors

extract report data from source platform, and dynamically customize each report’s content and layoutUse Case

Receipting Made Easy: Automated, Accurate, Efficient

Verify addresses and issue official donation receipts automatically

HOW WE SOLVED IT FOR THIS CLIENT

20,000+ receipts

automatically deliveredChallenges

Manual Address Verification

Time-consuming and error-proneInefficient Receipt Issuance

Slow and manual processesInaccurate Addresses

Incorrect addresses can lead to undelivered receiptsScalability Issues

Difficulty handling large volumes of receipts.Impact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Enhanced data accuracy, reduced errorsScalability

Increased efficiency and scalability for handling large volumes of receiptsTimeliness

Aimely receipt issuance, improved donor satisfactionWrk Automation

API Connectors

extract all donor in CRM database, verify each donor’s address, and dynamically generates each individual receiptGmail API

sends each individual donor’s receiptUse Case

Skin Analysis Simplified: Personalized Treatment Recommendations

Analyze skin images, provide treatment recommendations, and send notifications

HOW WE SOLVED IT FOR THIS CLIENT

Instant and accurate analysis and treatment recommendations

Challenges

Manual Analysis

Time-consuming and subjectiveInaccurate Assessments

Manual assessments can be prone to errorsLimited Personalization

Difficulty providing personalized treatment recommendationsInefficient Communication

Inefficient Communication: Delayed or inconsistent communication with patientsImpact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Improved accuracy of skin analysis and recommendationsPersonalization

Tailored treatment recommendations for individual patientsCommunication

Improved patient communication and engagementWrk Automation

Webhooks

are received whenever a patient submits an image of themselvesAI bots

perform multiple different analyses of the imageAPI Connectors

generate and send results to patient in an email, SMS message, and voicemailUse Case

Turn Conversations into Tickets: Automated Ticket Creation

Convert Slack messages into tickets and assign to appropriate teams

HOW WE SOLVED IT FOR THIS CLIENT

Efficient ticket management, improved response times, enhanced customer satisfaction

Challenges

Manual Ticket Creation

Time-consuming and error-proneDelayed Responses

Delayed response times to customer inquiriesInconsistent Tracking

Difficulty tracking and managing customer requestsInefficient Communication

Inefficient communication channels can lead to customer dissatisfactionImpact

Efficiency

Reduced manual workload, improved response timesOrganization

Streamlined ticket management, improved trackingCommunication

Improved communication and collaboration between teamsCustomer Satisfaction

Enhanced customer satisfaction through timely responsesWrk Automation

Webhooks

are received whenever a customer messages a Slack channelAPI Connectors

extract the Slack user’s details and the request detailsAPI Connectors

create the request in the ticketing system, and the original Slack message is reacted to to acknowledge the reception of the requestUse Case

Fuel Your AI: Automated Data Extraction and Preparation

Extract data, prepare for AI training, and deliver

to modelHOW WE SOLVED IT FOR THIS CLIENT

Clean, structured data for AI model training, accelerated insights

Challenges

Manual Data Extraction

Time-consuming and error-proneInconsistent Data

Data from SEC filings is inconsistently formatted and difficult to processData Preparation

Preparing data for AI training can be complex and time-consumingScalability Issues

Difficulty handling large volumes of dataImpact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Improved data accuracy and consistencyScalability

Increased efficiency and scalability for handling large datasetsAI Model Performance

High-quality data can improve AI model performanceWrk Automation

Web Process Automation

pulls a list of the current S&P 500 companiesSEC EDGAR Filings API

retrieves each company’s latest 10-K documentHuman in the loop

meticulously extracts each individual risk factor found in each 10-K documentAI bots

summarize each individual risk factor section and convert to JSONGmail API

delivers the outputted JSON file to the client for upload into AI model

Use Case

Effortless Intent Based Lead Generation at Scale

Consume intent data on a daily basis and extract leads

HOW WE SOLVED IT FOR THIS CLIENT

100s of fresh leads

every dayChallenges

Time consuming

Our client’s marketing team manually getting leads from their G2 dataInefficiency

A lot of time was spent filtering and searching for relevant leads from the data

Scalability Issues

Could only be done ad hoc when someone on the team had timeImpact

Efficiency gain

Time saved from marketing so they can spend more time on more specialized tasks

Effortless scale

Leads delivered daily at scale

Wrk Automation

Web Process Automation

Process begins everytime a new work assignment is received.

Web Process Automation

Filter the company data based on factors like country and remove previously found companies

Zoominfo Wrk Action

Find leads based on the company data from the initial data

API Sync

add or update leads in client’s marketing tool

Use Case

Automated Invoice Matching

for Seamless ReconciliationReconcile drop-shipped invoices to the invoices of a distributor

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

invoice reconciliation

Challenges

Time consuming

Our client required reconciling invoices they send to clients with the distributor’s invoices for 100’s of invoices a monthInefficiency

A lot of time was spent comparing and collating the information

Scalability Issues

Could only be done ad hoc when someone on the team had timeImpact

Efficiency gain

Time saved from reading and comparing invoices manually

Effortless scale

Data delivered at scale whenever a new invoice comes in

Wrk Automation

Email triggered

Process begins everytime a new email is received.

Optical Character Recognition

Information from every invoice is extracted using OCR

Google Sheets

Invoice data is written into Sheets and matched together with custom formulas

Use Case

Effortless Intent Based Lead Generation at Scale

Consume intent data on a daily basis and

extract leadsHOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

data extractionChallenges

Time consuming

Having to extract all the details manually would have taken too much timeInefficiency

PDFs aren't designed for seamless data access

Scalability Issues

Our client required a more holistic view of details about their work from PDF documentsImpact

Efficiency gain

Time saved from having to manually extract details from the documents

Effortless scale

Data delivered at scale whenever a new document comes in

Strategically organized

Data in a structured spreadsheet is easier to manipulate and analyze

Wrk Automation

Email triggered

Process begins everytime a new email is received.

Optical Character Recognition

Information from every document is extracted using OCR

Google Sheets

Data is written in a structured datasheet that allows more analysis to be done

Use Case

Streamlined Work Order Responses for Property Management

Enhance your property management efficiency with automated responses to new work orders

HOW WE SOLVED IT FOR THIS CLIENT

Improved efficiency and consistency

Challenges

Time consuming

Manually responding to each work order can be incredibly time-intensive, especially as the volume increases.Human Error

Miscommunications, forgotten responses, or missed details can lead to frustrated tenant

Scalability Issues

As work orders pile up, managing everything manually becomes overwhelmingImpact

Efficiency gain

Fast response times, ensuring work orders are acknowledged and processed quickly without manual intervention

Effortless scale

Data delivered at scale whenever a new work order comes in

Strategically organized

Data in a structured spreadsheet is easier to manipulate and analyze

Wrk Automation

Email triggered

Process begins everytime a new work order email is received.

Generative AI

Troubleshooting tips are generated based on the work order details

Web Process Automation

A message is sent to the client by automating the work order management website

Use Case

Auto-Assign Work Orders for Effortless Property Management

Effortlessly delegate tasks with automated work

order assignmentHOW WE SOLVED IT FOR THIS CLIENT

Improved efficiency and consistency

Challenges

Time consuming

Manually assigning each work order can be incredibly time-intensive, especially as the volume increases.Inconsistent Data

Information about preferred vendors is different from the work order management software’s information

Scalability Issues

As work orders pile up, managing everything manually becomes overwhelmingImpact

Efficiency gain

Fast response times, ensuring work orders are assigned quickly without manual intervention

Effortless scale

Assignment at scale whenever a new work order comes in

Improved Consistency

Work orders are assigned without having to compare names with 100’s of vendorsWrk Automation

Email triggered

Process begins everytime a new work order email is received.

Generative AI

Does a “fuzzy match” on the name of the vendor on file vs what is found in the property management softwareWeb Process Automation

The matching name is assigned in the property management softwareUse Case

Seamless Payments, Simplified: Automated Reconciliation

Extract transaction data and reconcile against CRM records

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

payment reconciliationChallenges

Manual Data Entry

Time-consuming and prone to errorsDelayed Processing

Delays in reconciling payments can impact cash flow

Inaccurate Designations

Mismatched payment and program information can lead to errorsReport Generation Difficulties

Manual reporting is time-consuming and prone to inaccuraciesImpact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Increased data accuracy and consistency, reduced errors

Insights

Enhanced reporting capabilities for data-driven decision makingTransparency

Improved visibility into donation management processes

Wrk Automation

Data sources API

Pulls all transaction and donor data from payment portal

CRM API

Logs all missing giftsWeb Process Automation

updates any gift with an incorrect fund designationUse Case

Synchronized Success: Real-Time Data Synchronization

Synchronize data in real-time between two or more separate systems

HOW WE SOLVED IT FOR THIS CLIENT

Real-time data

synchronization

across multiple systemsChallenges

Manual Data Synchronization

Time-consuming and prone to errorsData Inconsistency

Mismatched data across systems can lead to inaccuraciesError Risk

Increased risk of data errors and omissions due to manual processes.Inefficient Resource Allocation

Significant time and effort spent on data managementImpact

Efficiency

Reduced manual workload, improved productivity

Accuracy

Enhanced data consistency and accuracy, reduced errors

Security

Improved security by reducing the need for multiple teams to access systems.Operational Efficiency

Streamlined workflows and improved decision-making

Wrk Automation

Webhooks

are received whenever a change is made to an opportunity

API Connectors

Locate the equivalent record in the other system, and add/update the recordUse Case

Streamlined Admissions: Automated Data Verification

Extract data from documents, verify against applicant information, and update records

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and complete applicant data, streamlined admissions process

Challenges

Manual Data Entry

Time-consuming and prone to errorsInefficient Document Verification

Slow and error-prone manual processesLow-Quality Images

Poor image quality can hinder data extractionData Inconsistency

Mismatched data across systems can lead to inaccuraciesImpact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Enhanced data accuracy and consistency, reduced errors

Quality

Improved document quality and legibilityApplicant Experience

Faster processing times and improved satisfaction

Wrk Automation

Webhooks

are received whenever a student application is received

Optical Character Recognition

verifies document image quality and extracts information from submitted documentsAPI Connectors

compare existing record data and update any discrepanciesUse Case

Dynamic Reports, Delivered: Automated PDF Generation

Generate custom PDF reports based on dynamic templates and data

HOW WE SOLVED IT FOR THIS CLIENT

Personalized and

professional reports

at scale, delivered

automaticallyChallenges

Manual Report Creation

Time-consuming and error-proneData Gathering

Difficulty collecting and compiling accurate dataInconsistent Layout

Maintaining consistent report layout and content can be challengingScalability Issues

Difficulty scaling reporting as the donor base growsImpact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Enhanced data accuracy and consistency, reduced errorsScalability

Increased efficiency and scalability of reporting processesTimeliness

Ability to provide donors with timely updates on the impact of their donationsWrk Automation

Human in the loop

retrieves images for the reports based on strict criteriaAPI Connectors

extract report data from source platform, and dynamically customize each report’s content and layoutUse Case

Receipting Made Easy: Automated, Accurate, Efficient

Verify addresses and issue official donation receipts automatically

HOW WE SOLVED IT FOR THIS CLIENT

20,000+ receipts

automatically deliveredChallenges

Manual Address Verification

Time-consuming and error-proneInefficient Receipt Issuance

Slow and manual processesInaccurate Addresses

Incorrect addresses can lead to undelivered receiptsScalability Issues

Difficulty handling large volumes of receipts.Impact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Enhanced data accuracy, reduced errorsScalability

Increased efficiency and scalability for handling large volumes of receiptsTimeliness

Aimely receipt issuance, improved donor satisfactionWrk Automation

API Connectors

extract all donor in CRM database, verify each donor’s address, and dynamically generates each individual receiptGmail API

sends each individual donor’s receiptUse Case

Skin Analysis Simplified: Personalized Treatment Recommendations

Analyze skin images, provide treatment recommendations, and send notifications

HOW WE SOLVED IT FOR THIS CLIENT

Instant and accurate

analysis and treatment recommendationsChallenges

Manual Analysis

Time-consuming and subjectiveInaccurate Assessments

Manual assessments can be prone to errorsLimited Personalization

Difficulty providing personalized treatment recommendationsInefficient Communication

Inefficient Communication: Delayed or inconsistent communication with patientsImpact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Improved accuracy of skin analysis and recommendationsPersonalization

Tailored treatment recommendations for individual patientsCommunication

Improved patient communication and engagementWrk Automation

Webhooks

are received whenever a patient submits an image of themselvesAI bots

perform multiple different analyses of the imageAPI Connectors

generate and send results to patient in an email, SMS message, and voicemailUse Case

Turn Conversations into Tickets: Automated Ticket Creation

Convert Slack messages into tickets and assign to appropriate teams

HOW WE SOLVED IT FOR THIS CLIENT

Efficient ticket management, improved response times, enhanced customer satisfaction

Challenges

Manual Ticket Creation

Time-consuming and error-proneDelayed Responses

Delayed response times to customer inquiriesInconsistent Tracking

Difficulty tracking and managing customer requestsInefficient Communication

Inefficient communication channels can lead to customer dissatisfactionImpact

Efficiency

Reduced manual workload, improved response timesOrganization

Streamlined ticket management, improved trackingCommunication

Improved communication and collaboration between teamsCustomer Satisfaction

Enhanced customer satisfaction through timely responsesWrk Automation

Webhooks

are received whenever a customer messages a Slack channelAPI Connectors

extract the Slack user’s details and the request detailsAPI Connectors

create the request in the ticketing system, and the original Slack message is reacted to to acknowledge the reception of the requestUse Case

Fuel Your AI: Automated Data Extraction and Preparation

Extract data, prepare for AI training, and deliver to model

HOW WE SOLVED IT FOR THIS CLIENT

Clean, structured data for AI model training, accelerated insights

Challenges

Manual Data Extraction

Time-consuming and error-proneInconsistent Data

Data from SEC filings is inconsistently formatted and difficult to processData Preparation

Preparing data for AI training can be complex and time-consumingScalability Issues

Difficulty handling large volumes of dataImpact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Improved data accuracy and consistencyScalability

Increased efficiency and scalability for handling large datasetsAI Model Performance

High-quality data can improve AI model performanceWrk Automation

Web Process Automation

pulls a list of the current S&P 500 companiesSEC EDGAR Filings API

retrieves each company’s latest 10-K documentHuman in the loop

meticulously extracts each individual risk factor found in each 10-K documentAI bots

summarize each individual risk factor section and convert to JSONGmail API

delivers the outputted JSON file to the client for upload into AI model

Use Case

Effortless Intent Based Lead Generation at Scale

Consume intent data on a daily basis and extract leads

HOW WE SOLVED IT FOR THIS CLIENT

100s of fresh leads

every dayChallenges

Time consuming

Our client’s marketing team manually getting leads from their G2 dataInefficiency

A lot of time was spent filtering and searching for relevant leads from the data

Scalability Issues

Could only be done ad hoc when someone on the team had timeImpact

Efficiency gain

Time saved from marketing so they can spend more time on more specialized tasks

Effortless scale

Leads delivered daily at scale

Wrk Automation

Web Process Automation

Process begins everytime a new work assignment is received.

Web Process Automation

Filter the company data based on factors like country and remove previously found companies

Zoominfo Wrk Action

Find leads based on the company data from the initial data

API Sync

add or update leads in client’s marketing tool

Use Case

Automated Invoice Matching

for Seamless ReconciliationReconcile drop-shipped invoices to the invoices of a distributor

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

invoice reconciliation

Challenges

Time consuming

Our client required reconciling invoices they send to clients with the distributor’s invoices for 100’s of invoices a monthInefficiency

A lot of time was spent comparing and collating the information

Scalability Issues

Could only be done ad hoc when someone on the team had timeImpact

Efficiency gain

Time saved from reading and comparing invoices manually

Effortless scale

Data delivered at scale whenever a new invoice comes in

Wrk Automation

Email triggered

Process begins everytime a new email is received.

Optical Character Recognition

Information from every invoice is extracted using OCR

Google Sheets

Invoice data is written into Sheets and matched together with custom formulas

Use Case

Effortless Intent Based Lead Generation at Scale

Consume intent data on a daily basis and

extract leadsHOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

data extractionChallenges

Time consuming

Having to extract all the details manually would have taken too much timeInefficiency

PDFs aren't designed for seamless data access

Scalability Issues

Our client required a more holistic view of details about their work from PDF documentsImpact

Efficiency gain

Time saved from having to manually extract details from the documents

Effortless scale

Data delivered at scale whenever a new document comes in

Strategically organized

Data in a structured spreadsheet is easier to manipulate and analyze

Wrk Automation

Email triggered

Process begins everytime a new email is received.

Optical Character Recognition

Information from every document is extracted using OCR

Google Sheets

Data is written in a structured datasheet that allows more analysis to be done

Use Case

Streamlined Work Order Responses for Property Management

Enhance your property management efficiency with automated responses to new work orders

HOW WE SOLVED IT FOR THIS CLIENT

Improved efficiency and consistency

Challenges

Time consuming

Manually responding to each work order can be incredibly time-intensive, especially as the volume increases.Human Error

Miscommunications, forgotten responses, or missed details can lead to frustrated tenant

Scalability Issues

As work orders pile up, managing everything manually becomes overwhelmingImpact

Efficiency gain

Fast response times, ensuring work orders are acknowledged and processed quickly without manual intervention

Effortless scale

Data delivered at scale whenever a new work order comes in

Strategically organized

Data in a structured spreadsheet is easier to manipulate and analyze

Wrk Automation

Email triggered

Process begins everytime a new work order email is received.

Generative AI

Troubleshooting tips are generated based on the work order details

Web Process Automation

A message is sent to the client by automating the work order management website

Use Case

Auto-Assign Work Orders for Effortless Property Management

Effortlessly delegate tasks with automated work

order assignmentHOW WE SOLVED IT FOR THIS CLIENT

Improved efficiency and consistency

Challenges

Time consuming

Manually assigning each work order can be incredibly time-intensive, especially as the volume increases.Inconsistent Data

Information about preferred vendors is different from the work order management software’s information

Scalability Issues

As work orders pile up, managing everything manually becomes overwhelmingImpact

Efficiency gain

Fast response times, ensuring work orders are assigned quickly without manual intervention

Effortless scale

Assignment at scale whenever a new work order comes in

Improved Consistency

Work orders are assigned without having to compare names with 100’s of vendorsWrk Automation

Email triggered

Process begins everytime a new work order email is received.

Generative AI

Does a “fuzzy match” on the name of the vendor on file vs what is found in the property management softwareWeb Process Automation

The matching name is assigned in the property management softwareUse Case

Seamless Payments, Simplified: Automated Reconciliation

Extract transaction data and reconcile against CRM records

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and efficient

payment reconciliationChallenges

Manual Data Entry

Time-consuming and prone to errorsDelayed Processing

Delays in reconciling payments can impact cash flow

Inaccurate Designations

Mismatched payment and program information can lead to errorsReport Generation Difficulties

Manual reporting is time-consuming and prone to inaccuraciesImpact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Increased data accuracy and consistency, reduced errors

Insights

Enhanced reporting capabilities for data-driven decision makingTransparency

Improved visibility into donation management processes

Wrk Automation

Data sources API

Pulls all transaction and donor data from payment portal

CRM API

Logs all missing giftsWeb Process Automation

updates any gift with an incorrect fund designationUse Case

Synchronized Success: Real-Time Data Synchronization

Synchronize data in real-time between two or more separate systems

HOW WE SOLVED IT FOR THIS CLIENT

Real-time data

synchronization

across multiple systemsChallenges

Manual Data Synchronization

Time-consuming and prone to errorsData Inconsistency

Mismatched data across systems can lead to inaccuraciesError Risk

Increased risk of data errors and omissions due to manual processes.Inefficient Resource Allocation

Significant time and effort spent on data managementImpact

Efficiency

Reduced manual workload, improved productivity

Accuracy

Enhanced data consistency and accuracy, reduced errors

Security

Improved security by reducing the need for multiple teams to access systems.Operational Efficiency

Streamlined workflows and improved decision-making

Wrk Automation

Webhooks

are received whenever a change is made to an opportunity

API Connectors

Locate the equivalent record in the other system, and add/update the recordUse Case

Streamlined Admissions: Automated Data Verification

Extract data from documents, verify against applicant information, and update records

HOW WE SOLVED IT FOR THIS CLIENT

Accurate and complete applicant data, streamlined admissions process

Challenges

Manual Data Entry

Time-consuming and prone to errorsInefficient Document Verification

Slow and error-prone manual processesLow-Quality Images

Poor image quality can hinder data extractionData Inconsistency

Mismatched data across systems can lead to inaccuraciesImpact

Efficiency

Reduced manual workload, improved processing times

Accuracy

Enhanced data accuracy and consistency, reduced errors

Quality

Improved document quality and legibilityApplicant Experience

Faster processing times and improved satisfaction

Wrk Automation

Webhooks

are received whenever a student application is received

Optical Character Recognition

verifies document image quality and extracts information from submitted documentsAPI Connectors

compare existing record data and update any discrepanciesUse Case

Dynamic Reports, Delivered: Automated PDF Generation

Generate custom PDF reports based on dynamic templates and data

HOW WE SOLVED IT FOR THIS CLIENT

Personalized and

professional reports

at scale, delivered

automaticallyChallenges

Manual Report Creation

Time-consuming and error-proneData Gathering

Difficulty collecting and compiling accurate dataInconsistent Layout

Maintaining consistent report layout and content can be challengingScalability Issues

Difficulty scaling reporting as the donor base growsImpact

Efficiency

Reduced manual workload, improved processing timesAccuracy

Enhanced data accuracy and consistency, reduced errorsScalability

Increased efficiency and scalability of reporting processesTimeliness

Ability to provide donors with timely updates on the impact of their donationsWrk Automation

Human in the loop

retrieves images for the reports based on strict criteriaAPI Connectors