Publish Date

2023-10-16

Introduction to Credit Memos

Accuracy is paramount — every transaction must be accounted for, recorded, and analyzed precisely. Among the tools that facilitate this precision, credit memos stand out as crucial documents. Credit memos serve as a record of financial transactions and play a vital role in boosting transaction accuracy. In this blog, we will delve into the world of credit memos, exploring their significance, components, and how they help maintain accuracy in financial transactions.

What is a Credit Memo?

A credit memo, short for "credit memorandum," is a document that acknowledges a reduction in the amount owed by one party to another. It serves as a financial acknowledgment and communicates to the involved parties the adjustments made to an initial transaction. Credit memos come into play in various scenarios, each with unique purposes.

Components of a Credit Memo

Credit memos consist of several vital components to ensure accuracy and clarity in financial transactions. These components include:

Date of issuance

Credit memo number

Relevant reference numbers (e.g., invoice number)

Contact information of the issuer

Name and contact details of the customer

Customer account number

Billing address

Detailed description of the products or services

Quantity and unit price

Total amount to be credited

A clear and concise explanation of why the credit memo is issued

Supporting documentation if applicable (e.g., return authorization)

Signatures and names of individuals who authorized and processed the credit memo

Different Types of Credit Memos

Credit memos can take different forms based on the nature of the transaction. Some common types of credit memos include:

Return Credit Memo: Issued when a customer returns a product or cancels a service, resulting in a credit to their account.

Refund Credit Memo: Issued when a customer is owed a refund, typically due to an overpayment.

Adjustment Credit Memo: Issued to adjust a previous transaction's price, quantity, or other aspect.

Understanding these different types of credit memos is crucial for ensuring accurate financial transactions and maintaining transparency.

The Role of Credit Memos in Transaction Accuracy

Now that we've explored the elements of a credit memo, it's essential to understand how these documents contribute to transaction accuracy. Ensuring accuracy in financial transactions, preventing errors and discrepancies, impacting customer relations, compliance with accounting standards, and financial reporting and auditing are integral functions of credit memos in the financial operations of a company.

Issuing Credit Memos

Now that we understand the significance of credit memos, let's explore how they are issued and the steps involved in the process. Circumstances for issuing credit memos may include customer returns, overbilling, product defects, and price adjustments. The creation of a credit memo involves gathering necessary information, verifying the request, preparing the document, getting approval, and distributing the credit memo.

Importance of Accuracy in Credit Memo Creation

Creating a credit memo accurately is essential for several reasons, including impact on accounting and financial statements, legal and regulatory compliance, and customer trust and satisfaction.

Receiving and Processing Credit Memos

Issuing a credit memo is only one part of the process. Receiving and processing credit memos effectively is equally important to ensure transaction accuracy. How credit memos affect accounts receivable, verification and reconciliation, and applying credit memos to invoices are critical aspects of this process.

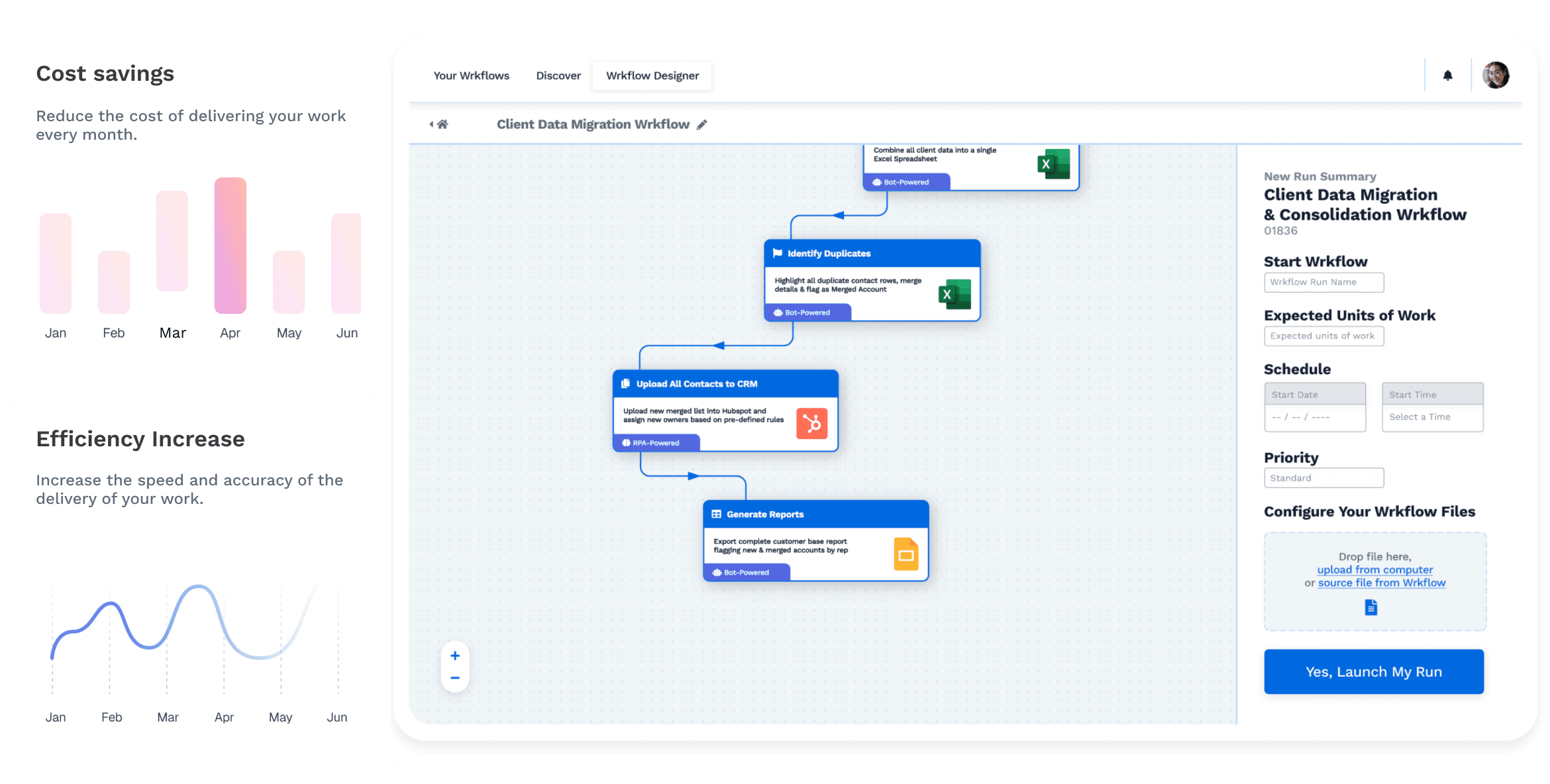

The Role of Automation in Credit Memo Processing

Modern businesses are increasingly relying on automation to streamline credit memo processing. Automation has revolutionized how credit memos are created, processed, and managed. Here's how automation plays a pivotal role in ensuring accuracy:

Error Reduction

Accelerated Processing

Consistency and Compliance

Improved Record-Keeping

Enhanced Transparency

Integration with Accounting Systems

Best Practices for Boosting Transaction Accuracy

To boost transaction accuracy when dealing with credit memos, businesses should consider implementing the following best practices:

Establishing Internal Controls

Training and Education

Consistent Documentation

Regular Reconciliation and Auditing

Leveraging Technology

Communication and Collaboration

Challenges and Pitfalls

While credit memos are essential tools for maintaining transaction accuracy, there are challenges and pitfalls that businesses need to be aware of:

Common Mistakes in Credit Memo Processing

Handling Customer Disputes

Legal and Regulatory Risks

Data Security and Privacy Concerns

Final Say

Understanding credit memos is about more than just creating and processing documents. It's about maintaining the accuracy and integrity of financial transactions. Credit memos are potent tools for rectifying errors, ensuring compliance, and fostering positive customer relationships. By following best practices, addressing challenges, and learning from real-world cases, businesses can harness the full potential of credit memos to boost transaction accuracy. In today's fast-paced and complex financial landscape, precision and transparency are more important than ever, and credit memos play a pivotal role in achieving these goals.